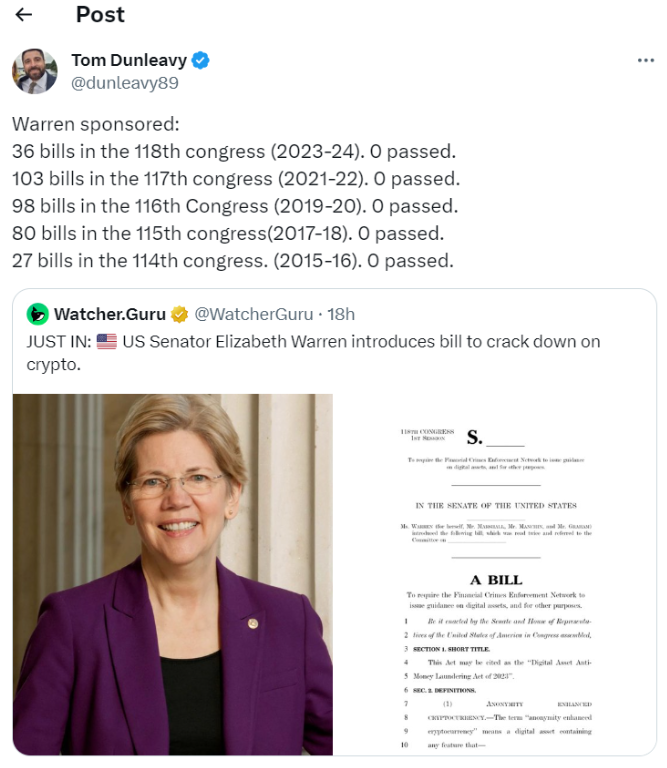

In a move that could reshape the regulatory landscape for cryptocurrencies, Senator Elizabeth Warren has introduced a robust anti-money laundering bill. The proposed legislation addresses concerns related to illicit activities involving digital assets by imposing stringent measures on various participants in the crypto ecosystem. Let’s delve into the key provisions and potential implications of Senator Warren’s ambitious proposal.

- Understanding the Key Provisions: KYC Requirements and Beyond

- Empowering Regulatory Authorities: Tools for Prosecution

- Tax Reporting Requirements: A Shift in Cryptocurrency Transactions

- Senator Warren’s Legislative Track Record: A Historical Context

- Potential Implications for Crypto Companies and Ecosystem Participants

- Navigating the Future of Cryptocurrency Regulation

Understanding the Key Provisions: KYC Requirements and Beyond

Senator Warren’s bill outlines a series of measures aimed at enhancing anti-money laundering (AML) practices within the cryptocurrency space. Notable provisions include the mandatory implementation of Know Your Customer (KYC) procedures by wallet providers, miners, validators, and other network participants. This move signifies a significant departure from the relatively pseudonymous nature of cryptocurrency transactions.

Empowering Regulatory Authorities: Tools for Prosecution

The proposed legislation empowers regulatory bodies, including the Ministry of Finance, the Securities and Exchange Commission, and the Commodity Futures Trading Commission, with enhanced tools to prosecute cryptocurrency companies.

This signals a concerted effort to close regulatory gaps and ensure a more robust framework for overseeing digital asset-related activities. The increased authority granted to these agencies reflects a stance toward monitoring and regulating the evolving crypto landscape.

Tax Reporting Requirements: A Shift in Cryptocurrency Transactions

Senator Warren’s bill introduces a substantial change to tax reporting obligations associated with cryptocurrency transactions. Under the proposed legislation, Americans engaging in transactions with cryptocurrencies valued at more than $10,000 will be obligated to report these activities to the tax office. This move aligns with broader efforts to enhance transparency and compliance within the crypto sphere.

Senator Warren’s Legislative Track Record: A Historical Context

It’s crucial to consider Senator Warren’s legislative track record when evaluating the potential fate of this proposed bill. Since 2015, Warren has been associated with the registration or preparation of 344 bills. However, none of these bills have been passed by Congress. This historical context raises questions about the feasibility of enacting such comprehensive cryptocurrency regulations.

Potential Implications for Crypto Companies and Ecosystem Participants

The implications of Senator Warren’s bill extend beyond regulatory compliance. Wallet providers, as well as miners, validators, and other network participants, may face operational challenges in implementing the mandated KYC procedures. Crypto companies, already navigating a dynamic regulatory landscape, could experience increased scrutiny and potential legal ramifications.

Discover more! Bitcoin as a Global Payment Network

Navigating the Future of Cryptocurrency Regulation

As Senator Warren’s anti-money laundering bill makes its way through legislative discussions, the cryptocurrency community braces for potential shifts in regulatory dynamics.

The proposed measures, if enacted, could significantly impact how digital assets are transacted, monitored, and reported. Whether these proposed regulations strike a balance between combating illicit activities and fostering innovation remains a topic of considerable debate.