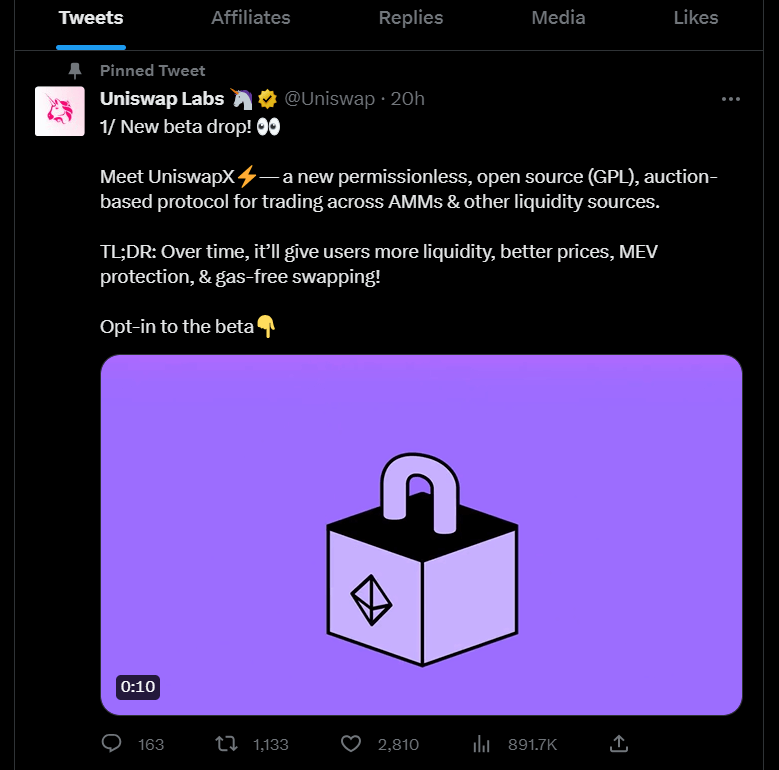

Uniswap, one of the leading decentralized exchanges (DEXs) in the blockchain industry, recently introduced “UniswapX,” a blockchain protocol designed to facilitate trading across automated market makers (AMMs) and other liquidity sources. The general concept brings us the following benefits:

- No gas fees for swapping

- MEV protection

- No extra cost for failed transactions

- Gas-free cross-chain swaps (coming soon)

This innovative development aims to enhance the trading experience and expand the liquidity options for users. In this article, we will delve into the potential advantages and drawbacks of UniswapX, analyzing its impact on the decentralized finance (DeFi) ecosystem.

Advantages of UniswapX

- Enhanced Liquidity Options: UniswapX allows traders to access liquidity from various AMMs and other sources. By integrating multiple liquidity pools, UniswapX offers a broader range of assets and potentially deeper liquidity, which can improve trading efficiency and reduce slippage.

- Improved Price Discovery: With UniswapX, users can benefit from enhanced price discovery as it aggregates liquidity from different sources. That can lead to more accurate and competitive pricing, enabling traders to make more informed decisions.

- Diverse Trading Strategies: The introduction of UniswapX opens doors for traders to employ different trading strategies across various liquidity sources. This flexibility can empower users to optimize their trading approaches and potentially increase their returns.

Potential Drawbacks and Challenges

- Complexity and Fragmentation: While integrating multiple AMMs and liquidity sources is promising, it also introduces complexity and fragmentation. Traders may face challenges in navigating and understanding the different protocols and liquidity options available within UniswapX, potentially leading to a steeper learning curve.

- Security and Trust: As UniswapX expands the integration of various liquidity sources, ensuring the security and trustworthiness of these sources become paramount. The risk of smart contract vulnerabilities and the need to thoroughly audit all integrated protocols become crucial factors in maintaining user confidence.

- Governance and Decision-Making: The introduction of UniswapX raises questions about the governance and decision-making processes. Balancing the interests and incentives of different liquidity sources and maintaining a fair and transparent governance mechanism can be challenging.

Impact on DeFi Ecosystem

UniswapX’s introduction signifies a notable step towards expanding the possibilities within the DeFi ecosystem. By enabling trading across AMMs and diverse liquidity sources, UniswapX has the potential to promote healthy competition, innovation, and collaboration among different protocols. The increased interoperability and liquidity options can further fuel the growth of decentralized finance, attracting more users and capital to the ecosystem.

Conclusion

UniswapX, Uniswap’s blockchain protocol for trading across AMMs and other liquidity sources, brings advantages and challenges to the DeFi landscape. While it offers enhanced liquidity options, improved price discovery, and diversified trading strategies, the complexity, fragmentation, and security concerns cannot be ignored. As UniswapX evolves, addressing these challenges will ensure the protocol’s long-term success and maintain a robust and secure trading environment. Ultimately, UniswapX’s impact on the DeFi ecosystem will depend on how effectively it addresses these concerns and delivers value to its users.