In a remarkable shift within the cryptocurrency landscape, Bitcoin Exchange-Traded Funds (ETFs) are now absorbing Bitcoin at a rate ten times greater than what miners can produce. This unprecedented demand from Bitcoin ETFs has introduced a new dynamic to the supply and demand equation of the world’s first decentralized digital currency. As this trend continues to unfold, it raises several critical questions about the future price of Bitcoin, the sustainability of its mining ecosystem, and the overall impact on the cryptocurrency market. Coinhackz.com delves into the implications of this phenomenon, exploring how the growing popularity of Bitcoin ETFs is reshaping the traditional paradigms of cryptocurrency acquisition and ownership.

The Surge in Bitcoin ETF Demand

Bitcoin ETFs have emerged as a popular investment vehicle for both institutional and retail investors looking to gain exposure to Bitcoin without the complexities of direct ownership, such as wallet security and management. These financial products allow investors to buy shares that represent the underlying value of Bitcoin, with the ETF providers typically holding the actual Bitcoin in reserve. As these ETFs have gained approval in various jurisdictions, their appetite for Bitcoin has soared, outstripping the supply generated by miners.

Implications for Bitcoin’s Price

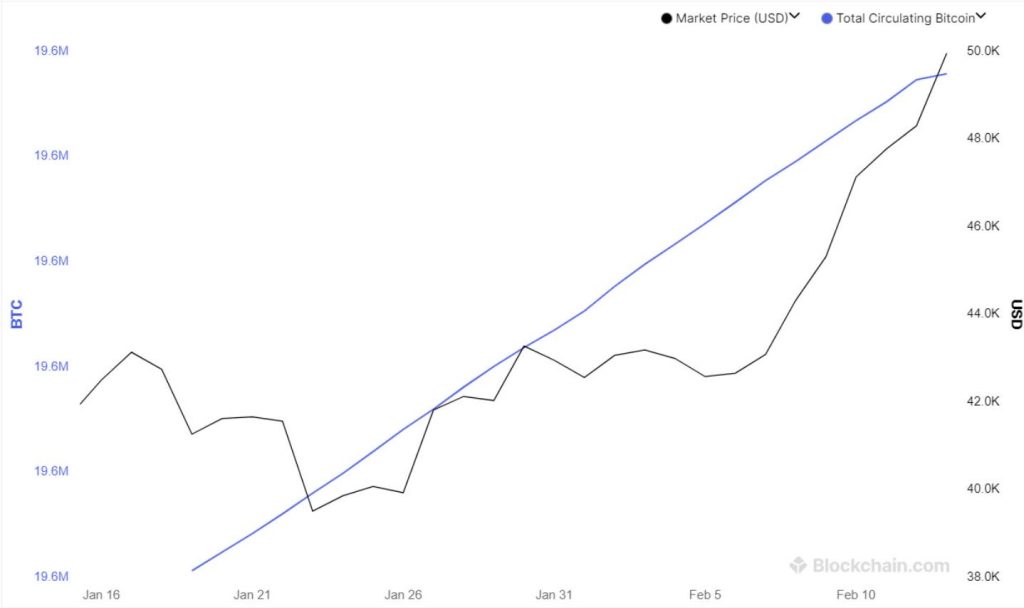

- Supply Constraints: With Bitcoin ETFs purchasing more Bitcoin than miners can supply, a significant supply constraint is introduced into the market. According to basic economic principles, if demand exceeds supply, prices are likely to rise. This dynamic could contribute to upward pressure on Bitcoin’s price, particularly during periods of heightened ETF buying activity.

- Increased Market Volatility: The mismatch between demand from ETFs and the supply of newly mined Bitcoin could lead to increased price volatility. Rapid price movements may become more common as the market adjusts to the influx of ETF-related buying pressure.

Sustainability of the Mining Ecosystem

The growing disparity between ETF demand and mining output also casts a spotlight on the sustainability of the Bitcoin mining ecosystem. Miners are rewarded with newly created Bitcoin for validating transactions and securing the network, a process that requires significant computational power and energy. If the economic incentives for mining diminish due to supply constraints, it could have long-term implications for network security and transaction validation.

Potential Market Impact

- Encouraging Alternative Acquisition Methods: The high demand from ETFs may encourage market participants to explore alternative methods of acquiring Bitcoin, such as over-the-counter (OTC) transactions, to meet investor demand without exacerbating supply constraints.

- Influence on Other Cryptocurrencies: As Bitcoin becomes increasingly difficult to acquire due to ETF absorption, investors may turn their attention to other cryptocurrencies, potentially leading to increased investment and interest across the broader digital asset market.

Conclusion

The overwhelming demand from Bitcoin ETFs, outpacing the supply capabilities of miners, marks a significant evolution in the cryptocurrency ecosystem. While this trend may bolster Bitcoin’s price and highlight its growing acceptance among mainstream investors, it also introduces challenges related to supply constraints, market volatility, and the sustainability of mining operations. As the cryptocurrency landscape continues to evolve, the interplay between Bitcoin ETFs and mining output will remain a critical area of focus for investors, regulators, and market analysts alike. Understanding these dynamics will be essential for navigating the future of Bitcoin and the digital asset market as a whole.