In the volatile world of cryptocurrency, where transparency and trust are paramount, Tether’s recent ambiguity regarding its stablecoin, USDT, on the Tron blockchain has sent ripples through the market. Tether, the company behind the world’s most widely used stablecoin, has neither confirmed nor denied reports suggesting a possible discontinuation of USDT issuance on the Tron network. This lack of clarity has sparked widespread speculation and concern among investors, traders, and blockchain enthusiasts alike. As a leading source for cryptocurrency insights, coinhackz.com delves into the implications of Tether’s reticence, the potential impact on the Tron ecosystem, and the broader significance for the stablecoin market.

Tether and Tron: A Partnership in Limbo?

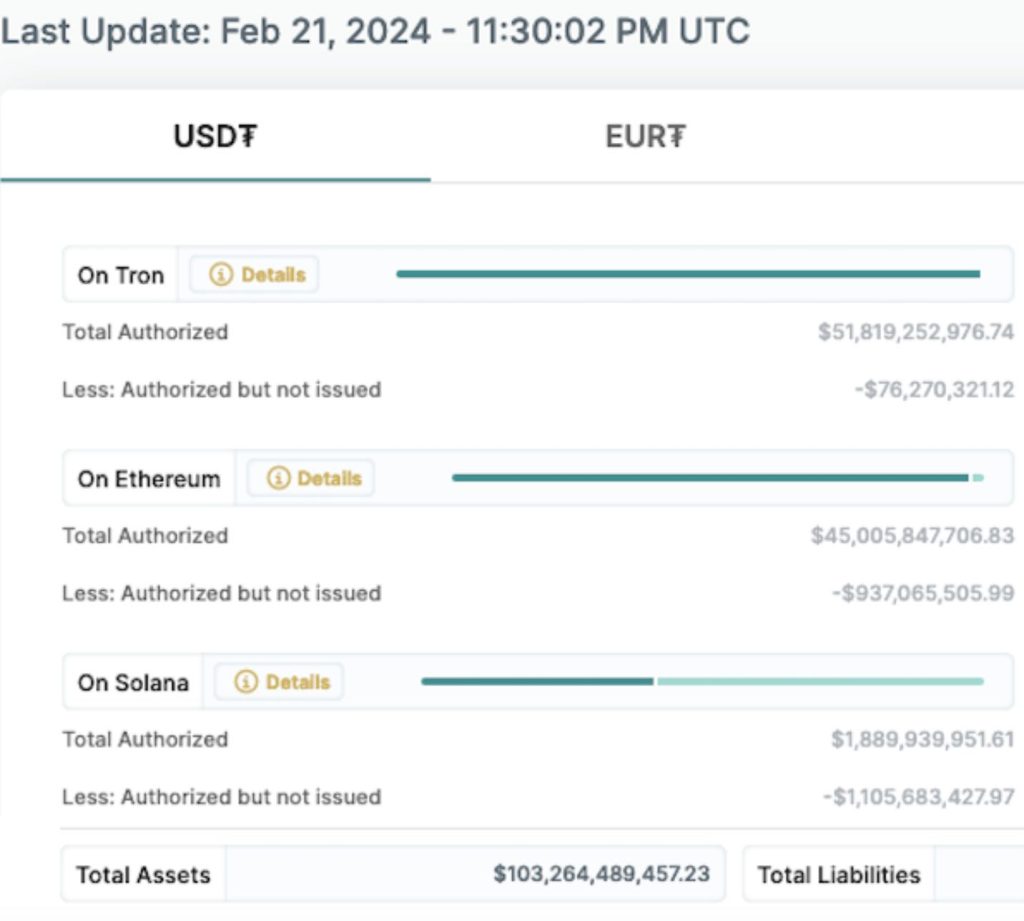

Tether’s USDT has been a cornerstone of the crypto economy, providing a stable value proposition amidst the market’s inherent volatility. Its integration with various blockchains, including Tron, has allowed for swift and cost-effective transactions, contributing significantly to Tron’s appeal as a platform for decentralized applications (dApps) and high-volume trading. However, Tether’s recent silence on its future plans with Tron has left many questioning the stability and reliability of using USDT within this ecosystem.

Market Speculation and Investor Concerns

The uncertainty surrounding Tether’s stance on Tron has led to a flurry of speculation within the crypto community. Investors and users of the Tron network are left pondering the potential ramifications, including liquidity issues and the inconvenience of transitioning to alternative stablecoins. The situation underscores the fragile nature of market confidence and the paramount importance of clear communication from major players like Tether.

Potential Implications for the Tron Ecosystem

Should Tether decide to reduce its presence or discontinue USDT issuance on Tron, the impact on the Tron ecosystem could be multifaceted:

- Liquidity Challenges: USDT on Tron plays a critical role in facilitating transactions and trading on the network. A withdrawal could lead to reduced liquidity, affecting everything from dApp operations to exchange activities.

- Search for Alternatives: Users might be compelled to seek other stablecoins, leading to increased transaction costs and potential compatibility issues with existing applications.

- Market Perception: The broader perception of Tron as a viable platform for development and investment could suffer, potentially slowing growth and innovation within its ecosystem.

Broader Significance for the Stablecoin Market

The situation between Tether and Tron highlights several critical issues within the larger stablecoin market:

- Diversification and Dependence: The reliance on a single stablecoin issuer across multiple blockchains accentuates the need for diversification and the development of alternative stablecoins to mitigate risk.

- Regulatory Scrutiny: As stablecoins continue to gain prominence, the importance of regulatory clarity and issuer transparency becomes increasingly apparent, potentially shaping future policies and standards.

- Market Resilience: The crypto market’s response to Tether’s ambiguity with Tron will serve as a case study in resilience and adaptability, reflecting the community’s ability to navigate uncertainty.

Conclusion

Tether’s uncertain future with the Tron blockchain serves as a poignant reminder of the complexities and dependencies woven into the fabric of the cryptocurrency market. As the situation unfolds, it will undoubtedly provide valuable lessons on the importance of transparency, communication, and diversification within the crypto ecosystem. Whether Tether continues its partnership with Tron or not, the crypto community’s response will likely shape the strategic decisions of stablecoin issuers and blockchain platforms for years to come.