MicroStrategy’s recent inclusion in the S&P 500 index has sent shockwaves through the financial world, sparking speculation about the implications for Bitcoin adoption. As one of the most prominent proponents of cryptocurrency, MicroStrategy’s listing could expose millions of investors to the world of Bitcoin, potentially reshaping the landscape of digital asset investment. In this article, we explore the significance of this development and its potential impact on the cryptocurrency market.

MicroStrategy: Pioneering Bitcoin Adoption

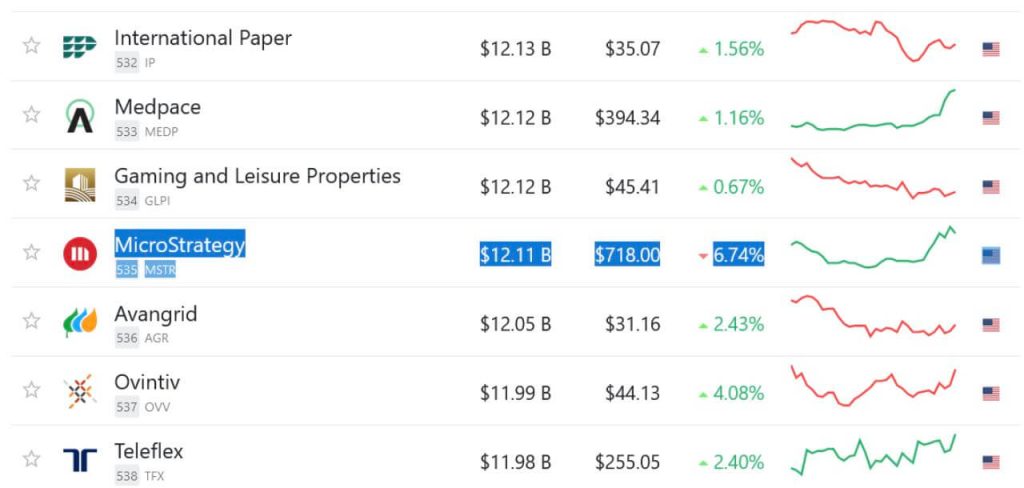

Led by CEO Michael Saylor, MicroStrategy has emerged as a trailblazer in the realm of Bitcoin adoption among traditional corporations. With its bold move to allocate significant reserves to Bitcoin, MicroStrategy has garnered attention from investors and analysts alike, positioning itself as a leading advocate for the digital asset. Now, with its listing in the prestigious S&P 500 index, MicroStrategy is poised to further mainstream Bitcoin adoption on a global scale.

Exposure to Bitcoin for Millions

The inclusion of MicroStrategy in the S&P 500 index opens the door for millions of investors to indirectly gain exposure to Bitcoin through the company’s stock. As institutional investors and index funds track the performance of the S&P 500, MicroStrategy’s presence in the index effectively introduces Bitcoin to a broader audience, including those who may have been previously hesitant or unaware of the digital asset.

Reshaping the Investment Landscape

MicroStrategy’s listing in the S&P 500 index has the potential to catalyze a seismic shift in the investment landscape, as traditional investors increasingly recognize the value proposition of Bitcoin. With the cryptocurrency gaining acceptance as a legitimate asset class, more institutional and retail investors may allocate funds to Bitcoin, driving up demand and potentially fueling further price appreciation.

Implications for the Cryptocurrency Market

The ramifications of MicroStrategy’s S&P 500 listing extend beyond mere exposure to Bitcoin. As more companies follow MicroStrategy’s lead and embrace Bitcoin as a treasury reserve asset, the cryptocurrency market could experience heightened liquidity and stability. Additionally, increased institutional interest in Bitcoin could pave the way for regulatory clarity and broader acceptance of digital assets in the mainstream financial ecosystem.

Looking toward the future

As MicroStrategy’s journey into the S&P 500 unfolds, the cryptocurrency community eagerly anticipates the potential ripple effects on Bitcoin adoption and market dynamics. Whether it’s through increased investor exposure or broader institutional acceptance, MicroStrategy’s listing marks a significant milestone in the ongoing integration of Bitcoin into traditional finance. As we look to the future, one thing is certain: the era of digital asset mainstreaming has only just begun.

Conclusion

MicroStrategy’s listing in the S&P 500 index represents a watershed moment for Bitcoin adoption, exposing millions of investors to the digital asset and potentially reshaping the investment landscape. As institutional interest in Bitcoin continues to grow, driven in part by MicroStrategy’s pioneering efforts, the cryptocurrency market stands on the brink of unprecedented transformation. With each new milestone, Bitcoin edges closer to widespread acceptance and recognition as a legitimate asset class in the global financial ecosystem.