In recent years, Nigeria has emerged as a focal point in the global discourse on cryptocurrency regulation and access. With a burgeoning youth population increasingly turning to digital currencies for investment and transactional purposes, the Nigerian government’s stance on cryptocurrency has become a subject of intense scrutiny. Recent access issues have sparked a wave of concern among users and investors, raising critical questions about the country’s regulatory intentions and the future of cryptocurrency within its borders. As we delve into this complex issue, it’s essential to examine the underlying factors contributing to these access problems and what they indicate about Nigeria’s approach to digital currency regulation.

Crypto Access Issues: A Symptom of Regulatory Ambiguity?

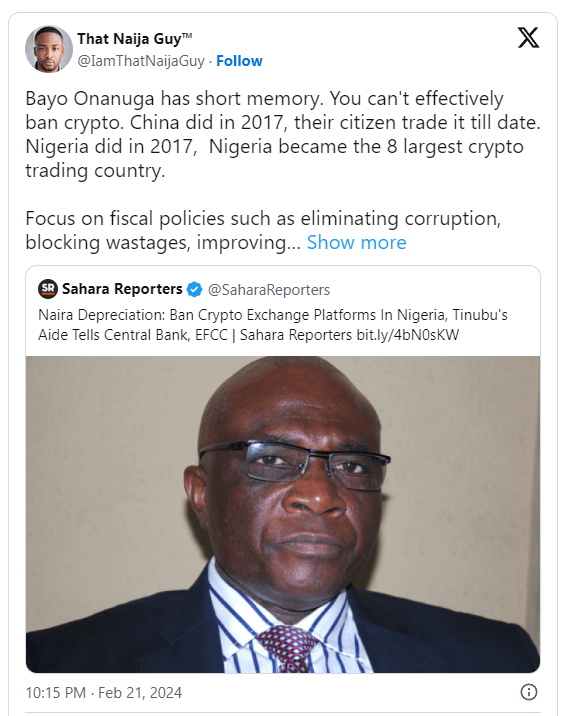

The crux of the matter lies in the recent challenges faced by Nigerian citizens in accessing cryptocurrencies. Reports of banking restrictions, stringent regulatory measures, and a general atmosphere of uncertainty have led to significant disruptions for both individual investors and crypto-related businesses. These access issues are not isolated incidents but rather symptoms of a broader regulatory ambiguity that has characterized Nigeria’s approach to cryptocurrencies.

The Central Bank’s Directive and Its Implications

In February 2021, the Central Bank of Nigeria (CBN) issued a directive to banks and financial institutions to desist from transacting in and facilitating payments for cryptocurrency exchanges. This move, intended to curb the perceived risks associated with digital currencies, has had far-reaching implications. It effectively cut off a critical access point for users, forcing them to seek alternative, often less secure, means of buying and selling cryptocurrencies. The directive has sparked a debate on the balance between regulatory oversight and fostering innovation in the financial sector.

The Case for Clearer Regulations

The current state of crypto access issues in Nigeria underscores the pressing need for clearer, more comprehensive regulations. Stakeholders argue that well-defined regulatory frameworks could mitigate risks without stifling the growth of the crypto market. Clear regulations would not only enhance consumer protection but also establish a more stable environment for crypto businesses to operate, potentially unlocking significant economic benefits for the country.

Looking Towards the Future: Regulatory Intentions and Market Growth

The question of Nigeria’s regulatory intentions remains at the forefront of discussions on the future of cryptocurrency in the country. While the CBN’s directive may suggest a cautious or even adversarial stance, there are signs that the Nigerian government recognizes the potential of digital currencies. Discussions around developing a national digital currency and exploring blockchain technology for governmental use indicate a more nuanced approach may be on the horizon.

Conclusion

The crypto access issues in Nigeria have ignited a crucial conversation about the role of regulation in the rapidly evolving world of digital currencies. As Nigeria navigates the challenges and opportunities presented by cryptocurrency, the path forward requires a delicate balance. By adopting clear, forward-thinking regulations, Nigeria has the potential to harness the economic and innovative benefits of cryptocurrencies while protecting its citizens from associated risks. The resolution of access issues and the clarification of regulatory intentions will be critical in shaping Nigeria’s digital financial landscape and its position in the global crypto economy.