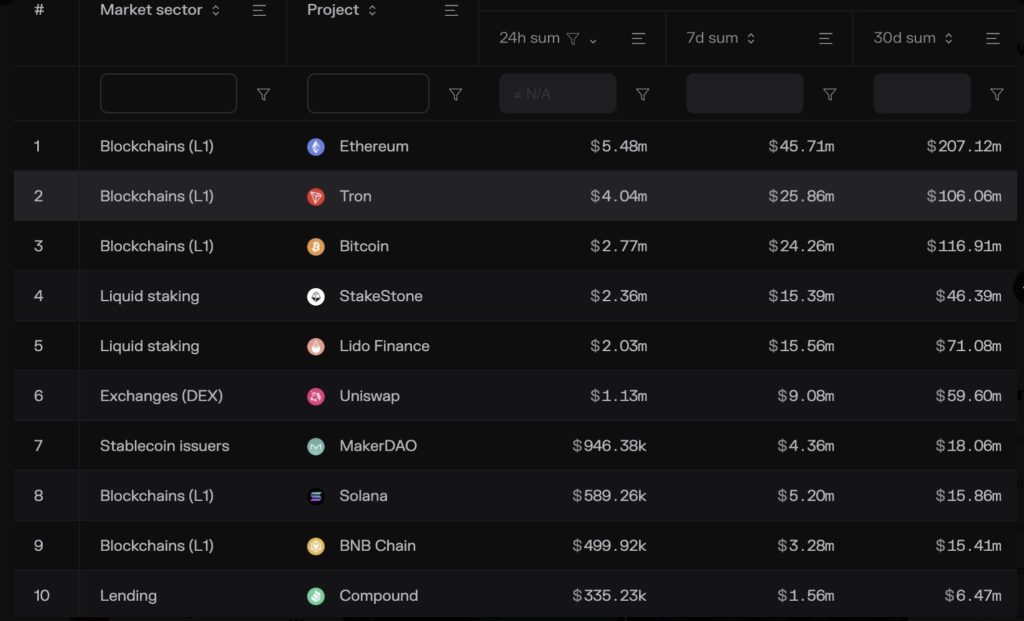

In the competitive arena of blockchain technologies, Tron has emerged as a formidable player, now ranking as the second most fee-generating crypto protocol, trailing only behind the behemoth, Ethereum. With daily fees skyrocketing from approximately $1 million in 2021 to around $4 million, and average transaction fees reaching nearly $0.9, Tron’s growth trajectory has caught the attention of the crypto community. This surge in activity and fees raises the question: What factors are propelling Tron’s ascent in the blockchain ecosystem? This article aims to dissect the elements driving Tron’s growth, focusing on its utility, scalability, and the pivotal role of Tether (USDT) stablecoin within the network.

The Catalysts for Tron’s Growth:

- Scalability and Efficiency: One of the foundational appeals of Tron is its commitment to providing a scalable and efficient platform for decentralized applications (DApps). Its ability to handle a substantial volume of transactions at lower costs, compared to Ethereum, has made it an attractive option for developers and users alike, contributing significantly to its growth.

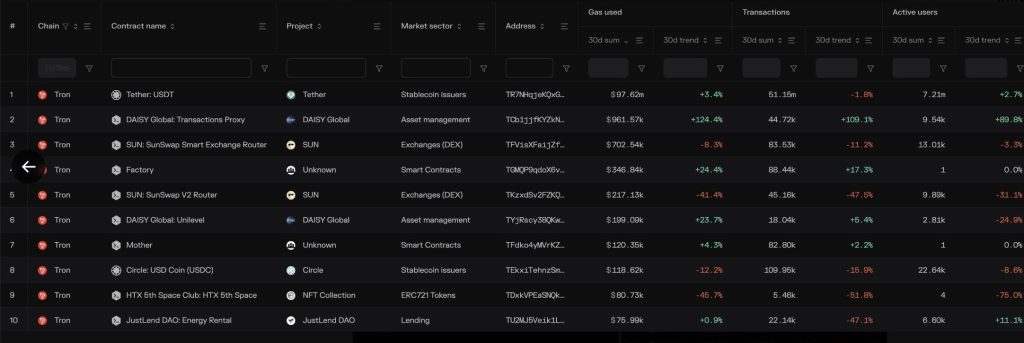

- USDT’s Dominance on Tron: The integration and widespread use of Tether (USDT) on the Tron network have been instrumental in its rise. As the most utilized contract, with close to $100 million in monthly gas consumption across approximately 7.2 million users, USDT has become a cornerstone of Tron’s economic activity. The stablecoin’s efficiency and lower transaction costs on Tron have encouraged adoption, making it a hub for stablecoin transactions.

- Strategic Partnerships and Expansion: Tron’s strategic partnerships and continuous expansion efforts have further solidified its position in the market. By collaborating with various entities across the entertainment, social media, and gaming sectors, Tron has diversified its ecosystem, attracting a broader user base and increasing its utility and transaction volume.

Challenges and Counterarguments:

Despite Tron’s impressive growth, it is not without its challenges and critics. Some argue that the increase in transaction fees, although still relatively low, could deter future growth and user adoption. Additionally, concerns regarding centralization and the network’s governance structure have been points of contention within the crypto community. Critics also highlight the volatile nature of crypto markets and regulatory uncertainties as potential obstacles to sustained growth.

Conclusion:

Tron’s ascension as a leading fee-generating crypto protocol is a testament to its scalability, efficiency, and the strategic integration of USDT. While its rise in transaction fees reflects increased usage and demand, it also underscores the network’s growing economic activity. Despite facing challenges and skepticism, Tron’s continued focus on expanding its ecosystem, enhancing user experience, and fostering strategic partnerships positions it as a significant force in the blockchain landscape. As the platform evolves, it will be crucial for Tron to address concerns around governance and centralization to maintain its growth trajectory and further cement its status within the crypto community.