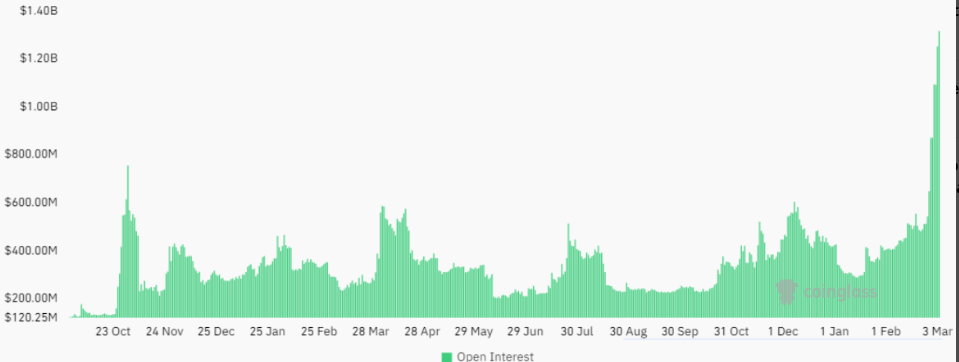

The cryptocurrency market, ever-dynamic and speculative, has recently witnessed a remarkable surge in Dogecoin (DOGE) open interest, crossing the $1.4 billion threshold. This significant milestone not only highlights the growing trader enthusiasm and investment in Dogecoin but also raises pertinent questions about the sustainability of this trend and the potential for a broader memecoin market correction. This article delves into the implications of Dogecoin’s open interest spike and explores whether the memecoin sector is on the cusp of a pivotal adjustment.

Understanding Open Interest in Dogecoin

Open interest, the total number of outstanding derivative contracts, such as futures and options, that have not been settled, serves as a crucial indicator of market sentiment and liquidity. A surge in Dogecoin’s open interest suggests an increased involvement from traders and investors, signaling robust trading activity and speculation surrounding the coin’s future price movements.

The Rise of Dogecoin and Memecoins

Dogecoin’s ascent from a joke cryptocurrency to a prominent player in the digital asset space exemplifies the meteoric rise of memecoins. Fueled by social media hype, celebrity endorsements, and a dedicated community, Dogecoin and its ilk have captivated the imagination of the crypto market, leading to significant price rallies and increased trading volumes.

Potential Catalysts for a Market Correction

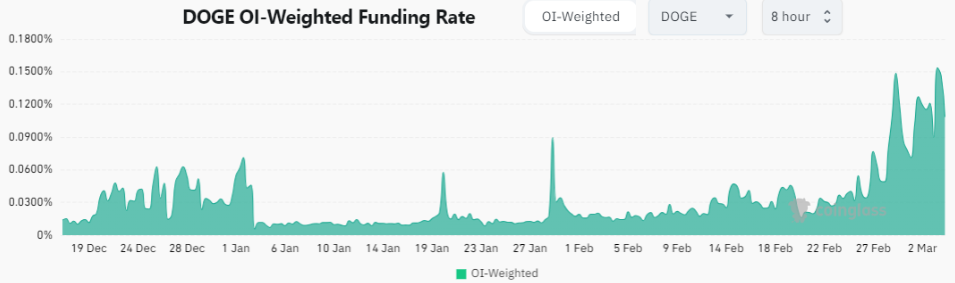

While the surging open interest in Dogecoin reflects positive market sentiment, it also brings to light the volatile and speculative nature of memecoins. Several factors could potentially trigger a market correction, including:

- Overvaluation: If the market price of Dogecoin significantly exceeds its intrinsic value based on fundamentals, a correction could readjust its price to more sustainable levels.

- Regulatory Scrutiny: Increased attention from regulatory bodies on cryptocurrencies, particularly those with speculative trading patterns like memecoins, could impact market sentiment and prices.

- Market Saturation: The continuous introduction of new memecoins vying for investor attention could dilute the market, leading to corrections as traders shift their focus and capital.

Navigating the Memecoin Market

Investors and traders navigating the memecoin market should exercise caution and perform due diligence. The allure of high returns comes with the risk of significant volatility. Diversification, risk management strategies, and staying informed about market trends and regulatory developments are crucial for those participating in the memecoin space.

Conclusion

The record-breaking open interest in Dogecoin is a testament to the coin’s enduring popularity and the speculative fervor that characterizes the memecoin market. While this surge underscores the vibrant trading activity and interest in Dogecoin, it also raises questions about market sustainability and the potential for corrections. As the cryptocurrency landscape continues to evolve, understanding the dynamics of memecoins and their impact on the broader market will be essential for traders and investors looking to capitalize on these digital assets’ unique opportunities and challenges.

Dogecoin’s $1.4 billion open interest represents a high level of engagement and trading activity in the market, suggesting strong investor interest and speculation regarding future price movements.

The memecoin market might face a correction due to factors like overvaluation, regulatory scrutiny, or market saturation with new memecoins, which could lead to shifts in investor sentiment and adjustments in prices to more sustainable levels.

Investors can navigate volatility by diversifying their portfolios, employing risk management strategies, staying informed about market and regulatory developments, and exercising caution in their investment decisions.

Social media buzz and celebrity endorsements have significantly contributed to Dogecoin’s popularity by boosting its visibility, attracting new investors, and driving speculative trading, which has impacted its price movements.

Successful strategies for trading Dogecoin and other memecoins include technical analysis to understand market trends, setting stop-loss orders to manage risks, and keeping abreast of news and events that could influence market sentiment.