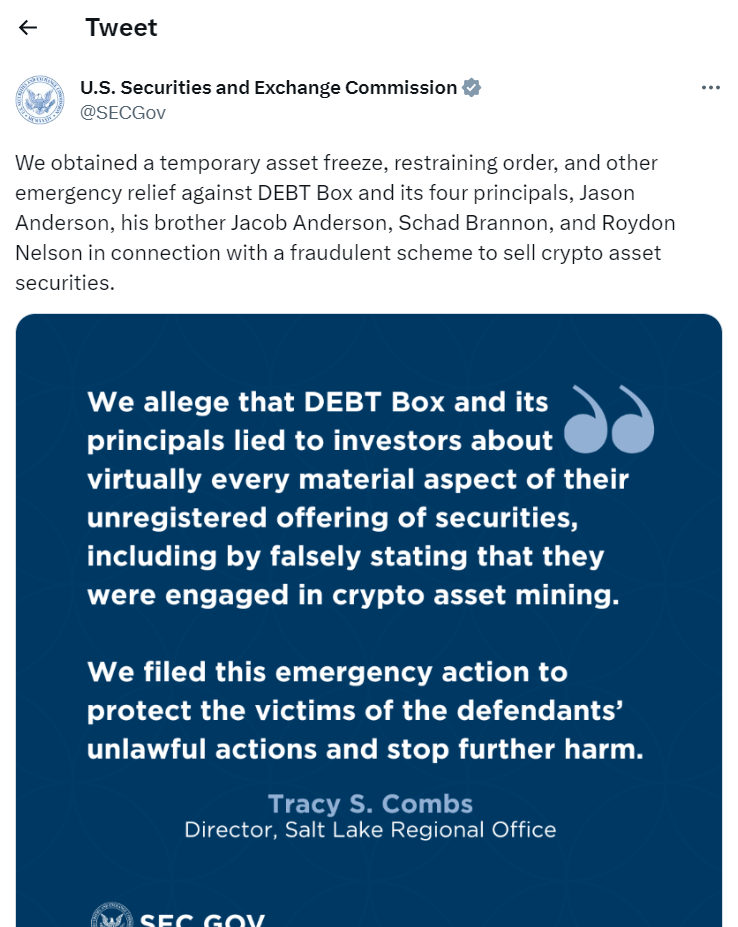

In a significant move to protect investors from fraudulent cryptocurrency schemes, the US Securities and Exchange Commission (SEC) has obtained a temporary asset freeze and restraining order against Digital Licensing, Inc., operating under the name DEBT Box, along with its principals and other defendants. The SEC’s complaint (the US District Court for the District of Utah) alleges that DEBT Box and its associates orchestrated a cryptocurrency scam that deceived hundreds of investors, resulting in nearly $50 million in losses.

The DEBT Box Deception

According to the SEC’s complaint, DEBT Box presented itself as a “decentralized, eco-friendly, blockchain technology project.” Through a scheme that began in March 2021, the defendants offered “node licenses” as unregistered securities to unsuspecting investors. These node licenses were promoted as investments to generate crypto asset tokens through crypto mining activities. The defendants claimed the tokens would gain substantial value due to revenue-generating businesses in various sectors. This misleading narrative enticed investors with promises of exorbitant gains.

The True Nature of the Node Licenses

However, the SEC alleges that the node licenses were nothing but a facade to conceal the reality of the tokens’ creation. In reality, DEBT Box rapidly generated the total supply of each token using code on a blockchain. The entire operation was designed to give the illusion of legitimacy, masking that the tokens had no intrinsic value or real-world backing.

Misleading Marketing Tactics

The defendants used various marketing tactics to lure in more investors, including online videos, social media posts, and investor events. Through these channels, they disseminated false information about the profitability of the node licenses and the potential gains for investors. These deceptive marketing practices were crucial in swindling unsuspecting individuals from their hard-earned money.

Alleged Lies About Revenue Generation

The SEC’s complaint goes even further, accusing DEBT Box, its principals, and other defendants of lying to investors about the revenues generated by the businesses supposedly driving the tokens’ value. By falsifying information, they maintained a facade of success and sustainability, convincing investors that their investments were secure and profitable.

SEC’s Vigilance in Protecting Investors

The swift action the SEC took in obtaining a temporary asset freeze and restraining order against DEBT Box and its associates highlights the regulatory body’s commitment to safeguarding investors from fraudulent schemes in cryptocurrency. The SEC’s proactive approach to unearthing such scams and taking legal action demonstrates its dedication to maintaining the integrity of the financial markets.

Conclusion

The SEC’s enforcement action against DEBT Box and its principals sheds light on the dark underbelly of the cryptocurrency industry, where deceitful individuals seek to exploit unsuspecting investors for personal gain. By obtaining a temporary asset freeze and restraining order, the SEC has taken a decisive step to protect investors and maintain transparency in the crypto market.

The DEBT Box case serves as a cautionary tale for investors, urging them to exercise due diligence and skepticism when approached with promises of quick riches in cryptocurrency. Regulatory authorities, like the SEC, play a crucial role in identifying and stopping such fraudulent activities, reinforcing the need for strong oversight in the rapidly evolving landscape of digital assets. Investors must remain vigilant, and regulators must remain steadfast in their pursuit of justice to uphold the integrity of the financial ecosystem.

Previously, we reported about Binance Japan’s Token Listing: Outshining Competitors or a Gateway to Web3? Stay with HodlHacker for more news!