In the ever-evolving landscape of cryptocurrency exchanges, competition can be fierce. However, a recent lawsuit has taken the rivalry between Binance and FTX to a new level. Allegations suggest that a tweet by Binance CEO Changpeng Zhao, commonly known as CZ, led to a significant crash in FTX’s native token, FTT.

The Coindesk Revelation

The foundation of the lawsuit rests on a Coindesk report released on November 2nd, 2022, which shed light on Alameda’s financial health. The report revealed that a substantial portion of Alameda’s assets, totaling $14.6 billion, were tied up in unsecured FTT tokens. This finding set the stage for the events that followed, raising concerns about FTX’s stability and solvency.

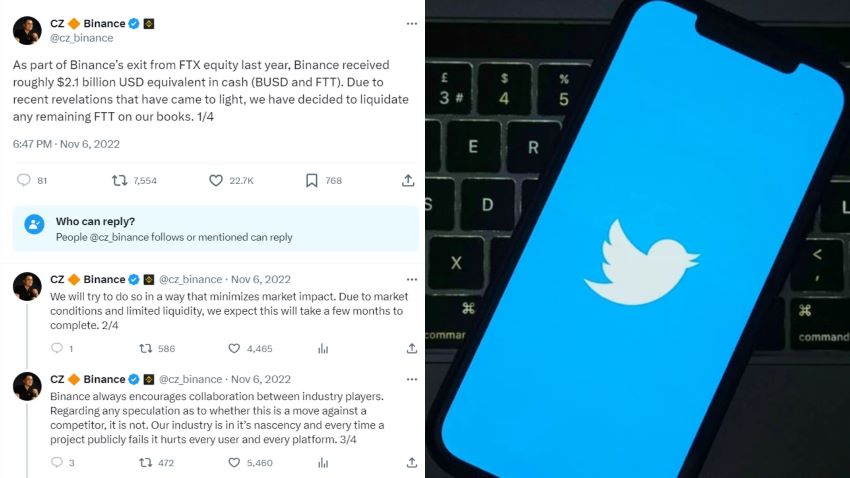

CZ’s Tweet and Its Impact

On November 6th, CZ took to Twitter to announce Binance’s intention to withdraw liquidity from FTX and sell its FTT tokens. In the world of cryptocurrencies, where market sentiment can sway rapidly, CZ’s tweet had an immediate impact. FTT’s price plummeted from $24 to $22 within hours, causing significant market turbulence.

Just two days later, FTT’s value further nosedived, hitting a low of $4.

The Accusations of Deliberate Sabotage

The core accusation in the lawsuit centers on CZ’s tweet being a calculated move to destabilize FTX and eliminate a formidable competitor. Plaintiffs argue that CZ’s public announcement of Binance’s actions caused panic and led to a massive sell-off of FTT tokens. This, in turn, eroded confidence in FTX and potentially damaged its reputation and financial standing.

Implications for Competition and Market Integrity

The allegations in this lawsuit raise fundamental questions about the nature of competition within the cryptocurrency exchange ecosystem. While competition can drive innovation and benefit users, it must also adhere to ethical and legal boundaries. If proven true, CZ’s tweet would demonstrate the power of influential figures in the crypto space to manipulate markets, potentially at the expense of other players and investors.

The Role of Social Media in Cryptocurrency

This case highlights the significant role that social media, particularly Twitter, plays in the cryptocurrency world. Cryptocurrency prices and market sentiment are often heavily influenced by tweets and public statements made by industry leaders. The incident underscores the need for responsible and transparent communication within the crypto community to maintain market stability and integrity.

You might also be interested: David Marcus Envisions Bitcoin as a Global Payment Network

The Importance of Regulatory Oversight

As cryptocurrency markets continue to evolve, the need for robust regulatory oversight becomes increasingly apparent. Instances like this lawsuit emphasize the necessity for regulatory bodies to monitor and investigate potentially manipulative actions within the crypto industry. Such oversight is crucial to maintain investor confidence and ensure the integrity of the market.

Conclusion

The allegations in the new Binance lawsuit bring to the forefront the complexities of competition in the cryptocurrency exchange space. While the lawsuit unfolds, it serves as a reminder of the power that influential figures wield in the crypto world and the need for responsible behavior. Moreover, it underscores the importance of regulatory oversight to maintain a fair and transparent cryptocurrency market that benefits all participants, from exchanges to individual investors.