Legal Turmoil Sparks Token Surge: LUNC and USTC Rise as Montenegro Approves Extradition

Montenegro’s recent approval of the extradition of Do Kwon, the figurehead behind Terra Classic’s turbulent past, has sent shockwaves through the cryptocurrency landscape. As legal uncertainties loom, the tokens associated with Terra Classic, namely LUNC and USTC, have experienced substantial surges in value, reflecting the intricate relationship between legal developments and market dynamics.

Montenegro’s Decision and the Pending Ministerial Approval

Approving Do Kwon’s extradition to the United States or Korea is pivotal in the ongoing legal saga surrounding Terra Classic. The final hurdle, which is obtaining the approval of the Minister of Justice, adds an extra layer of suspense to the unfolding narrative.

The decision holds significant implications for the future of Terra Classic and its associated tokens, as Do Kwon faces accusations of fraud in the United States, which is linked to the collapse of Terra (LUNA) and stablecoin UST in Korea.

Discover other stories: Solana’s Founder: Waiting for Congress to Greenlight Stablecoins

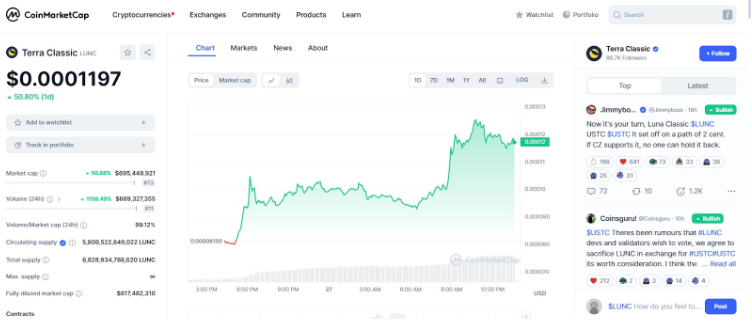

LUNC’s Resurgence

Amidst the legal turbulence, LUNC, the native token of Terra Classic, has experienced a remarkable resurgence in value. The token’s rate surged from 0.000075 to 0.00011+ (fluctuating), reflecting a staggering 40% increase. This sudden upswing underscores the sensitivity of cryptocurrency markets to external factors, especially those related to legal proceedings and the perceived stability of project leadership.

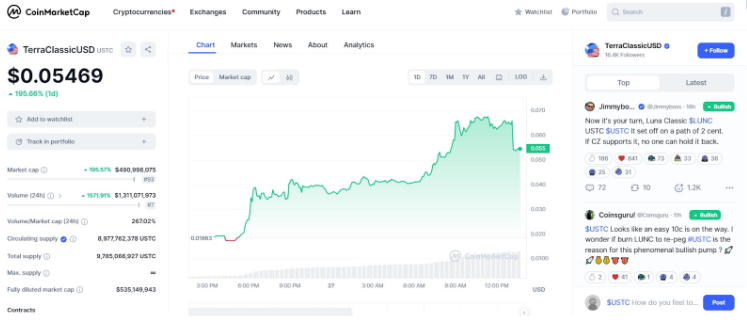

USTC’s Spectacular Rally

Simultaneously, USTC, Terra Classic’s stablecoin, witnessed an even more dramatic rally after Montenegro’s extradition approval. The stablecoin’s rate skyrocketed from $0.013 to $0.065, constituting a staggering 450% surge (it has already lost some of its value, though). With a current capitalization of $494 million and 8+ billion tokens in circulation, USTC’s resurgence is capturing the attention of investors and industry observers alike.

Background on Terra Classic’s Struggles

To comprehend the significance of these token surges, it’s essential to revisit the background of Terra Classic. Born as a fork of the widely accepted Terra blockchain, Terra Classic faced a severe problem (collapse even) in 2022, shaking its community’s and investors’ confidence. The Terra Classic community has since been ardently working to revive the value of its tokens, particularly focusing on restoring the peg of its currency to the US dollar.

The Interplay Between Legal Uncertainties and Market Sentiment

The unexpected rise of LUNC and USTC is a testament to the intricate interplay between legal developments and market sentiment within the cryptocurrency realm. While legal troubles often cast a shadow over a project, the resilience and responsiveness of the Terra Classic community, coupled with external factors such as Montenegro’s extradition decision, have triggered renewed investor interest.

The unfolding legal drama surrounding Do Kwon’s extradition has catalyzed significant market movements within the Terra Classic ecosystem. The resurgence of LUNC and USTC underscores the dynamic nature of the cryptocurrency landscape, where legal uncertainties can unexpectedly shape the trajectory of token values. As the Terra Classic community navigates through these tumultuous times, the resilience displayed by its tokens raises questions about the intricate relationship between legal proceedings, market dynamics, and the future of decentralized projects in the crypto space.