In a groundbreaking move that signals the growing acceptance of the crypto industry, mining equipment manufacturer Phoenix Group has secured an impressive $371 million in its initial public offering (IPO) on the Abu Dhabi Stock Exchange (ADX). This momentous event not only marks the largest IPO in the region but also stands as the first-ever listing of a crypto firm on the markets of the Middle East.

Unprecedented Demand in Semi-Closed Format

The IPO, conducted in a semi-closed format with prior registration for access, witnessed an unparalleled level of investor interest. According to Bloomberg reports, institutional buyers displayed an overwhelming demand, exceeding the available allocations by 33 times. Retail investors were equally enthusiastic, surpassing the available allocations by 180 times. This surge in demand reflects the strategic allure of Phoenix Group and underlines the growing appetite for crypto-related investments in the Middle East.

Phoenix’s Debut on the Abu Dhabi Stock Exchange

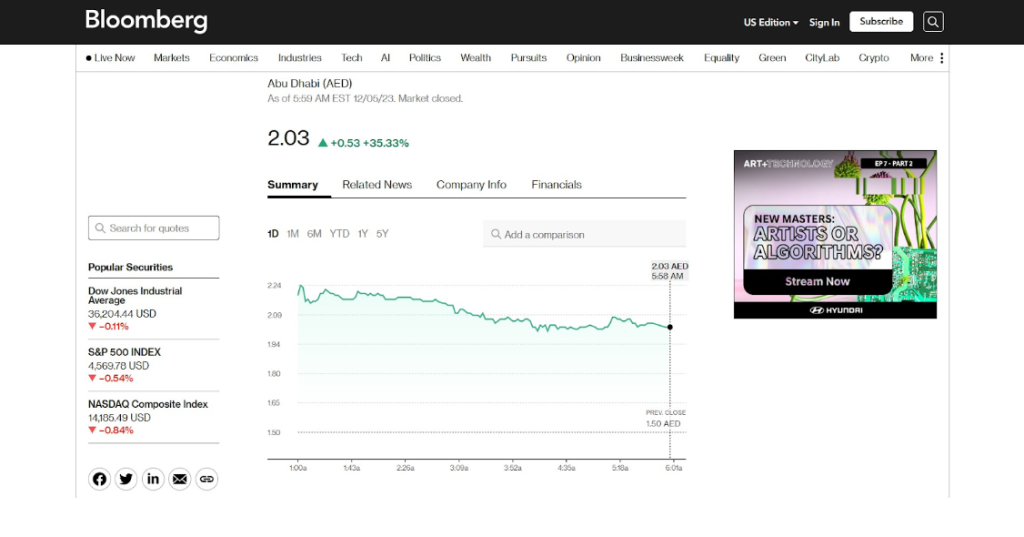

With the IPO completed, Phoenix Group’s shares commenced trading on the Abu Dhabi Stock Exchange (ADX). The debut was spectacular, with the shares experiencing a rapid ascent. Starting at the IPO price of $0.4 (equivalent to 1.5 UAE dirhams), the shares soared to $0.6 (2.20 dirhams) within the first day of trading. This remarkable increase in value propelled Phoenix Group’s capitalization to an impressive $2.52 billion, validating investors’ confidence in the crypto-mining sector.

Market Response and Investor Confidence

The overwhelming demand and positive market response underscore investors’ confidence in Phoenix Group and, by extension, the broader crypto industry. The successful IPO signifies a pivotal moment in the Middle East’s financial landscape as traditional markets embrace the evolving dynamics of blockchain and crypto-related ventures. Phoenix Group’s ability to secure such substantial funding validates the company’s strategic vision and sets a precedent for other crypto firms eyeing regional markets.

Middle East’s Growing Role in Crypto Markets

Phoenix Group’s IPO in Abu Dhabi makes history and positions the Middle East as an emerging player in the global crypto markets. As the region increasingly adopts and integrates blockchain technologies, the IPO’s success indicates a maturing financial landscape that embraces innovation. The Middle East’s strategic location and commitment to fostering innovation contribute to its potential to become a significant hub for crypto-related activities.

Discover more! Binance’s Ambitious Expansion: Navigating Hong Kong

Conclusion: A Defining Moment for Crypto in the Middle East

The successful IPO of Phoenix Group on the Abu Dhabi Stock Exchange marks a defining moment for the crypto industry in the Middle East. Beyond the impressive fundraising, this event symbolizes the region’s openness to embrace and invest in emerging technologies. As the first crypto firm to go public in the Middle East, Phoenix Group paves the way for others, reinforcing the transformative potential of blockchain and crypto ventures in the traditional financial landscape of the region.