In a thrilling turn of events, the world of cryptocurrency is buzzing with excitement as Bitcoin’s price appears poised to reach the coveted $60,000 mark. This remarkable potential comes as the MVRV metric, known for its historical accuracy, closely follows the patterns of previous Bitcoin bull cycles. As we explore the fascinating world of MVRV, we uncover valuable insights into what could lie ahead for the world’s leading cryptocurrency.

Understanding the MVRV Metric

The MVRV (Market-Value-to-Realized-Value) metric is a powerful tool for analyzing Bitcoin’s price movements. It measures the difference between the current market price and the realized value of Bitcoin, providing unique insights into the market’s sentiment and potential.

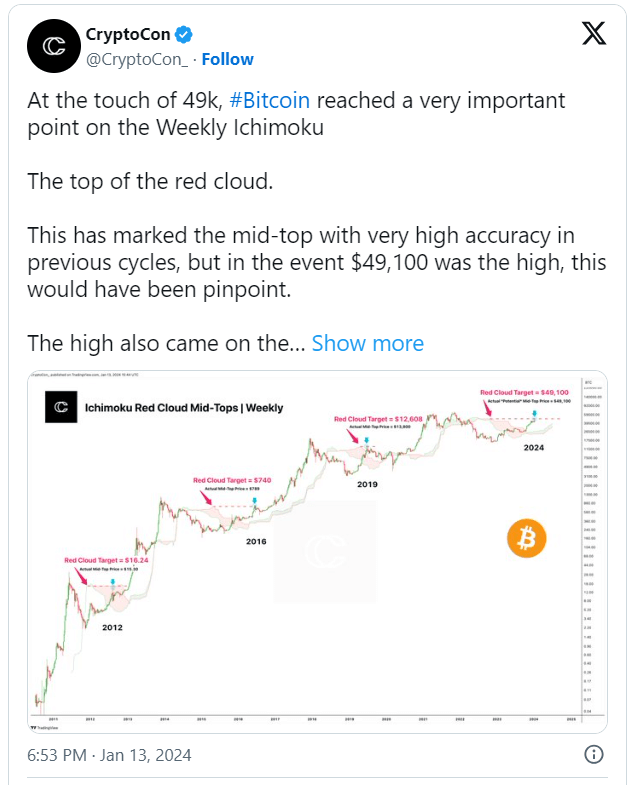

Historical Patterns: MVRV and Bitcoin Bull Cycles

One of the most intriguing aspects of the MVRV metric is its ability to mimic past Bitcoin bull cycles with striking accuracy. Previous bull markets have seen MVRV peak at certain levels before significant price rallies. This historical correlation suggests that Bitcoin’s current MVRV levels could be an indicator of what’s to come.

The $60,000 Potential

By examining the MVRV metric in detail, experts have noticed a pattern that points to a potential Bitcoin price of $60,000. This exciting revelation has reignited bullish sentiments within the cryptocurrency community, as it aligns with historical data that indicates significant price appreciation following similar MVRV levels.

Factors Driving the Bullish Sentiment

Several factors contribute to the optimistic outlook for Bitcoin’s price:

- Institutional Adoption: The increasing interest from institutional investors and corporations continues to fuel Bitcoin’s popularity and demand.

- Limited Supply: Bitcoin’s scarcity, with a capped supply of 21 million coins, amplifies its appeal as a store of value.

- Global Economic Uncertainty: Amid economic challenges worldwide, Bitcoin is seen as a hedge against inflation and currency devaluation.

- Improved Infrastructure: Enhanced crypto infrastructure, including exchanges and custody solutions, has made Bitcoin more accessible to investors.

- Growing Acceptance: Bitcoin’s acceptance as a legitimate asset class by governments and regulatory bodies further legitimizes its presence in the financial world.

Conclusion

The convergence of historical data and the current MVRV metric paints an enticing picture of Bitcoin’s potential. With a projected target of $60,000, the cryptocurrency market is eagerly anticipating the next phase of the Bitcoin bull cycle.

As we continue to witness the evolution of blockchain technology and digital assets, keeping a close eye on metrics like MVRV can offer valuable insights into market dynamics. Bitcoin’s journey to $60,000 may be a significant milestone, but it also underscores the ever-changing and dynamic nature of the cryptocurrency landscape.

For crypto enthusiasts and investors alike, these exciting developments reinforce the importance of staying informed and vigilant in an industry that is always ripe with opportunities and surprises. Stay tuned for the latest updates and trends as we navigate the fascinating world of cryptocurrency together.