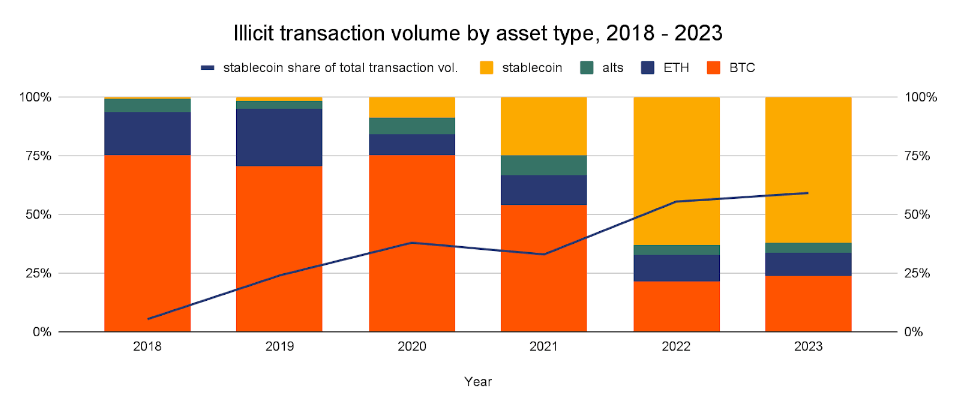

Cryptocurrencies have always been a subject of scrutiny when it comes to their potential use in illicit activities. A recent report for the year 2023 sheds light on a concerning trend: stablecoins have risen to prominence as the preferred choice for illicit transactions. In this article, we delve into the key findings of the report, highlighting the challenges and implications associated with this development.

- The Rise of Stablecoins: A Double-Edged Sword

- The Report’s Findings: Stablecoins Take the Lead

- Privacy Coins vs. Stablecoins: A Distinction

- Challenges for Regulatory Authorities: Tracing Illicit Activity

- The Importance of Regulatory Oversight: Striking a Balance

- Implications for the Crypto Industry: Reputation and Responsibility

- Conclusion: Addressing Challenges in a Maturing Crypto Landscape

The Rise of Stablecoins: A Double-Edged Sword

Stablecoins, known for their price stability, have gained popularity as a means of transferring value within the crypto space. However, their privacy features and ease of use have also made them attractive to actors engaged in illicit activities.

The Report’s Findings: Stablecoins Take the Lead

The report reveals that stablecoins, particularly those pegged to major fiat currencies like the US Dollar (USD), have surpassed other cryptocurrencies in terms of their use in illicit transactions. This trend underscores the need for enhanced regulatory measures.

Privacy Coins vs. Stablecoins: A Distinction

While privacy coins like Monero (XMR) and Zcash (ZEC) have long been associated with anonymity, stablecoins offer a different value proposition. Their stability and liquidity make them a practical choice for both legitimate and illicit purposes.

Challenges for Regulatory Authorities: Tracing Illicit Activity

The growing use of stablecoins for illicit transactions poses challenges for regulatory authorities. Tracing and monitoring these transactions require innovative solutions to maintain financial integrity.

The Importance of Regulatory Oversight: Striking a Balance

Regulatory oversight is essential to curb illicit activities while preserving the legitimate use of stablecoins. Striking the right balance between privacy and compliance remains a complex task.

Implications for the Crypto Industry: Reputation and Responsibility

The report’s findings underscore the importance of self-regulation within the crypto industry. Exchanges and projects must take responsibility for implementing robust AML (Anti-Money Laundering) and KYC (Know Your Customer) procedures.

Conclusion: Addressing Challenges in a Maturing Crypto Landscape

As the cryptocurrency landscape continues to evolve, addressing the challenges associated with stablecoins and illicit transactions becomes imperative. Collaboration between industry stakeholders and regulatory authorities is key to ensuring a secure and transparent crypto ecosystem.