The Lightning Network, a technology that has promised to revolutionize Bitcoin transactions, has recently encountered a significant challenge. A Bitcoin developer, Antoine Riard, has unearthed a vulnerability that could enable users to steal payments.

The Vulnerability Unveiled

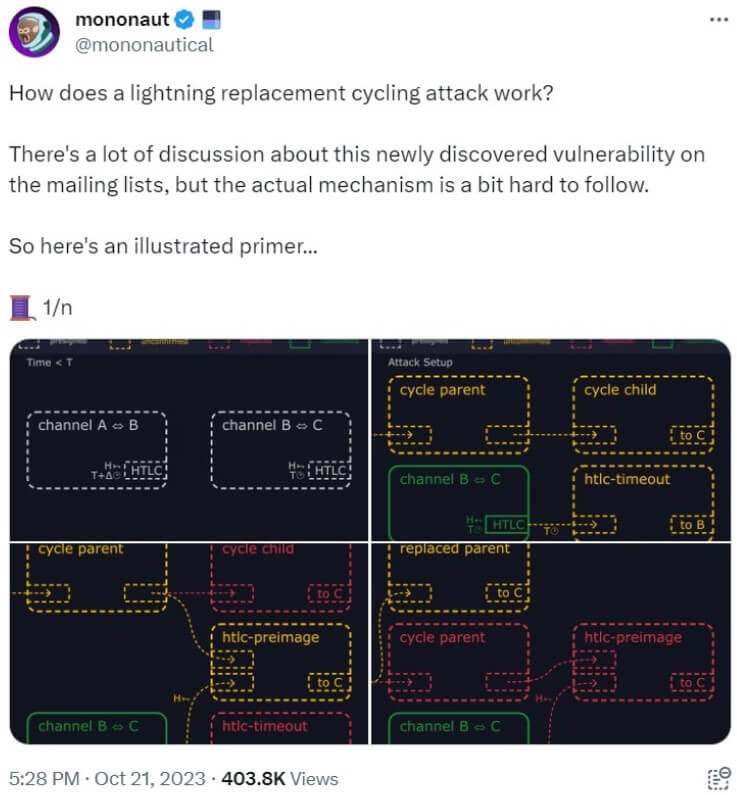

This vulnerability in the Lightning Network leverages a combination of loops and Hash/Time Locked Contracts (HTLCs). HTLCs are commonly used for secure, off-chain transactions in the Lightning Network. They operate on the principle that the recipient cannot spend the received bitcoins until they possess the preimage key. The attack scenario is complex, relying on multiple participants and intricate steps. You can read the whole thread here.

User A initiates a transaction by sending bitcoins to User B using HTLC. User B, in turn, promptly sends the same amount to User C using HTLC, a practice frequently seen within the Lightning Network. As part of the HTLC process, the automatic preimages are shared among the participants. Once these preimages are available, the HTLC contracts are resolved, and the transactions proceed as intended.

Exploiting the Weakness

The vulnerability arises when Users A and C conspire to block the preimage of the initial HTLC transaction by continuously updating transactions and increasing fees. This action prevents the completion of the transaction between User A and User B. Consequently, User B sends the intended bitcoins to User C, but the reciprocal transaction from User A never materializes.

This complex attack can lead to financial losses and potentially erode trust within the Lightning Network. It underscores the need for vigilance and continuous improvement in ensuring the security of Bitcoin’s innovative layer-two solution.

Antoine Riard’s Discovery

Antoine Riard, the Bitcoin developer who uncovered this vulnerability, has shed light on the seriousness of the issue. Riard suggests that two potential solutions may be considered to address this threat. The first is a soft fork of Bitcoin, which would introduce network protocol modifications to prevent such attacks. The second option involves developing third-party services to monitor and intervene to block these exploitative schemes.

The Importance of Safeguarding the Lightning Network

The Lightning Network is critical to Bitcoin’s quest for mass adoption. It promises to make Bitcoin transactions faster, cheaper, and more efficient. However, vulnerabilities like the one discovered by Riard remind us that the Lightning Network, like any technology, is not immune to threats.

Securing the Lightning Network is not just a technical challenge but a matter of trust within the Bitcoin community. Users must have confidence that their transactions are safe and that their funds are protected. These vulnerabilities can erode that trust and hinder the widespread adoption of Bitcoin.

You might be interested: Bitcoin Halving Countdown Goes Live

Seeking Solutions

As we face this vulnerability in the Lightning Network, the Bitcoin community must collaborate to find viable solutions. As Antoine Riard suggested, soft forks can enhance the security of the Bitcoin network. However, they may require time and coordination.

Third-party services that can identify and thwart exploitative schemes in the short term may offer a stopgap solution. Collaborative efforts among exchanges, Lightning Network node operators, and Bitcoin developers can help mitigate the risk posed by this vulnerability.

Conclusion

The recent discovery of a vulnerability in the Lightning Network is a stark reminder that even the most innovative technologies are not impervious to threats. However, these challenges can be addressed with the vigilance of developers like Antoine Riard and the collective resolve of the Bitcoin community.

Securing the Lightning Network is not just a technical necessity; it is an essential step in building a foundation of trust for the broader adoption of Bitcoin. As we work together to find solutions and bolster the network’s defenses, we can ensure that the promise of Bitcoin and its Lightning Network remains intact and continues to reshape the future of finance.