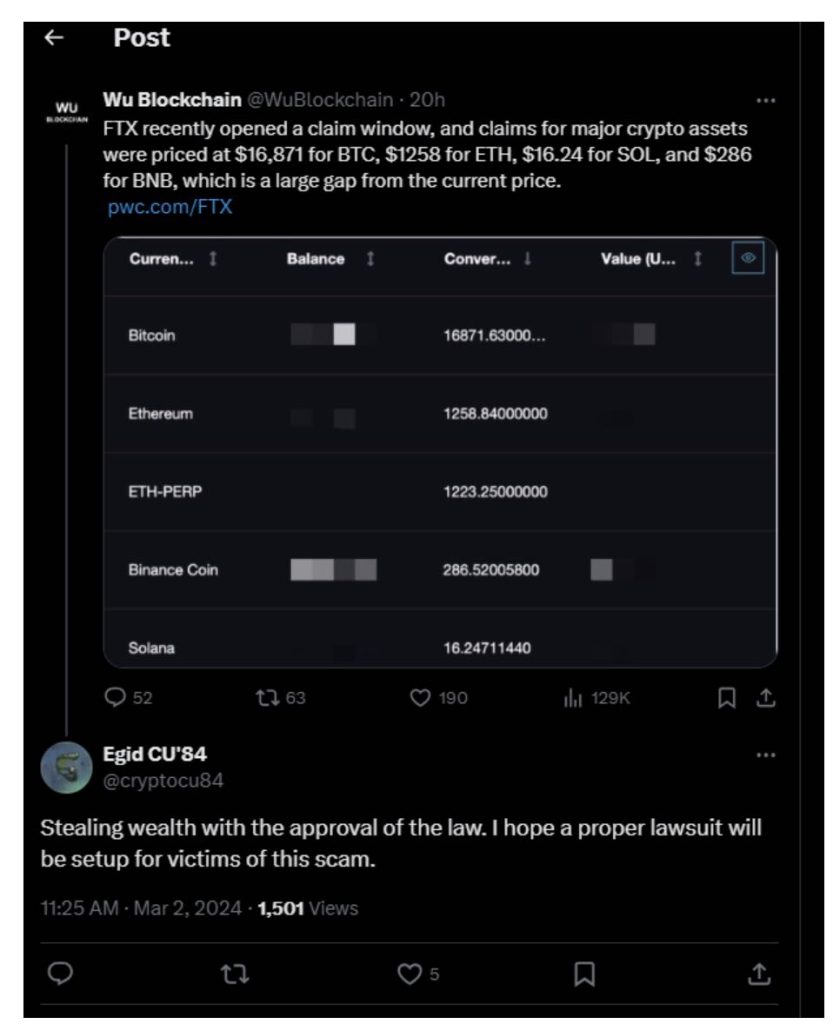

In a recent development that has stirred the cryptocurrency community, FTX, the cryptocurrency exchange that shook the world with its collapse, has opened its claim window for creditors. However, what’s caught everyone’s attention is the valuation of Bitcoin, Ethereum, and other digital assets at rates significantly below current market prices. This decision not only affects the potential recovery for those entangled in the FTX debacle but also raises questions about the implications for the wider cryptocurrency market. This article explores the nuances of FTX’s claim window pricing strategy and its potential impact on investors and the cryptocurrency landscape.

FTX’s Pricing Strategy: A Closer Look

As part of its bankruptcy proceedings, FTX has initiated a claims process for its creditors, a standard procedure in such cases. However, the valuation of cryptocurrencies for these claims has become a contentious issue. By setting the prices of major cryptocurrencies like Bitcoin and Ethereum below their prevailing market rates, FTX has sparked a debate on the fairness and rationale behind such a move.

Implications for Creditors and Investors

For creditors caught in the FTX collapse, the lower valuation means potentially receiving less than what their holdings might fetch in the open market. This discrepancy could lead to significant financial losses, above and beyond those already suffered from the exchange’s failure. Investors and industry observers are keenly watching this development, as it could set a precedent for how cryptocurrency assets are valued in bankruptcy and liquidation scenarios.

Market Response and Investor Sentiment

The cryptocurrency market is known for its volatility and sensitivity to news and developments. FTX’s decision to price assets below market rates has raised concerns about possible implications for investor sentiment and the market’s stability. While it’s uncertain how this will affect the broader market in the long term, the immediate response has been one of caution and uncertainty among investors.

Looking Ahead: Legal and Regulatory Considerations

FTX’s approach to asset valuation in its claim window highlights the need for clearer legal and regulatory frameworks around cryptocurrency bankruptcies. As the digital asset space continues to mature, the establishment of standardized practices for valuing and liquidating cryptocurrency holdings in such situations becomes increasingly important. This case could potentially influence future regulatory guidelines and legal proceedings involving cryptocurrency assets.

Conclusion

The opening of FTX’s claim window, with Bitcoin, Ethereum, and other cryptocurrencies priced below market rates, presents a complex challenge for creditors and raises broader questions for the cryptocurrency industry. As the situation unfolds, the impact on investor sentiment, market stability, and future regulatory practices will be closely monitored. The FTX saga continues to serve as a cautionary tale of the risks and complexities inherent in the cryptocurrency market, emphasizing the need for robust legal and regulatory frameworks to protect investors and maintain market integrity.