In the ever-evolving and dynamic world of cryptocurrency, market movements often trigger a cascade of reactions from investors, analysts, and industry leaders alike. A recent development that has captured the attention of the crypto community is the sell-off of Grayscale Bitcoin Trust (GBTC) shares by Genesis. This event has sparked widespread speculation regarding its potential impact on the broader crypto market. However, Coinbase, a leading cryptocurrency exchange platform, has weighed in with a reassuring perspective, suggesting that the market will balance out in the aftermath of this sell-off. This article for coinhackz.com delves into the Genesis GBTC sell-off, examining its implications and exploring Coinbase’s analysis of the situation.

The Genesis GBTC Sell-Off: An Overview

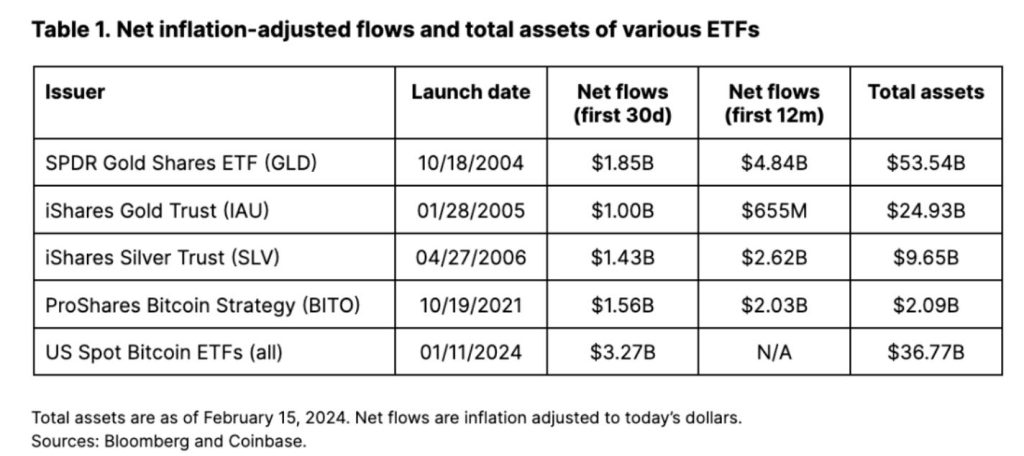

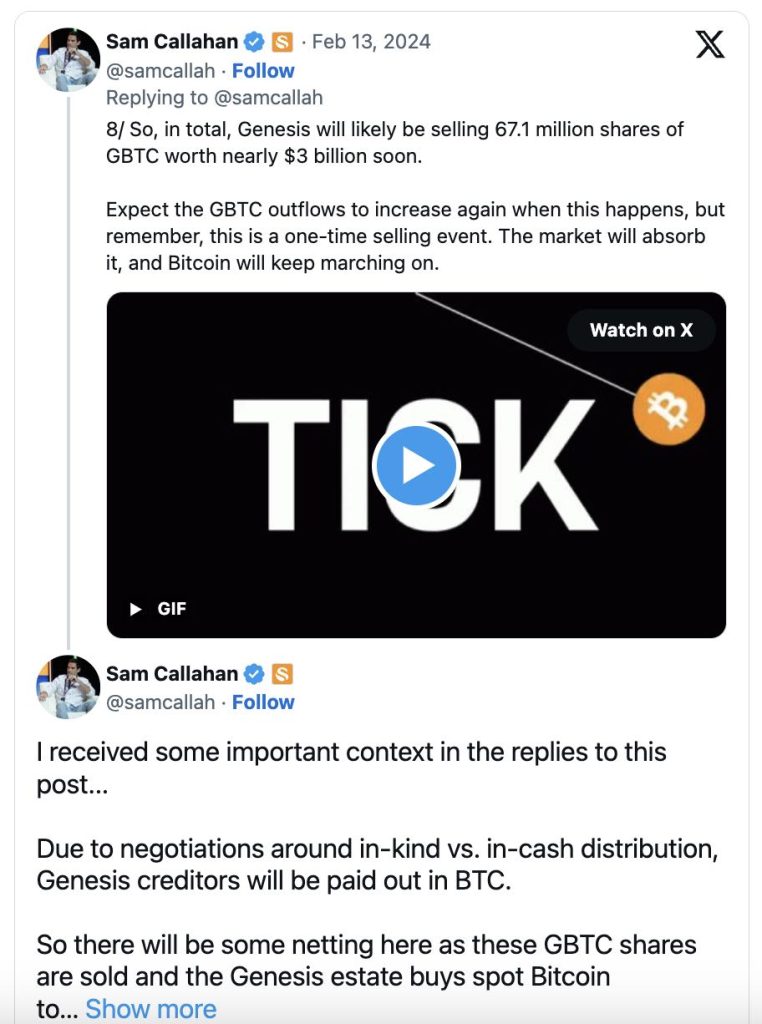

Genesis, a digital currency group company known for its pivotal role in the cryptocurrency lending space, made headlines with its decision to offload a significant portion of its GBTC shares. The Grayscale Bitcoin Trust, which offers investors exposure to Bitcoin in the form of a security without the challenges of buying, storing, and safekeeping Bitcoin directly, has been a popular investment vehicle, especially among institutional investors. The sell-off by Genesis raised concerns about potential market oversupply and the consequent pressure on GBTC share prices and Bitcoin valuations.

Coinbase’s Analysis: A Balanced Perspective

Coinbase, with its finger firmly on the pulse of the cryptocurrency market, has offered a more nuanced view of the situation. According to Coinbase:

- Market Absorption: The cryptocurrency market is known for its resilience and ability to absorb sell-offs and corrections. Coinbase suggests that while the Genesis GBTC sell-off might introduce temporary volatility, the market mechanisms are well-equipped to absorb the impact over time.

- Institutional Interest: The underlying interest in Bitcoin and related investment products like GBTC from institutional investors remains strong. Coinbase posits that this sustained interest will continue to provide a solid foundation for market stability and growth, counteracting the effects of sell-offs.

- Long-Term Outlook: Coinbase emphasizes the importance of maintaining a long-term perspective when evaluating market events such as the Genesis GBTC sell-off. The platform suggests that the fundamentals of Bitcoin and the broader cryptocurrency ecosystem remain robust, indicating healthy market prospects beyond short-term fluctuations.

Implications for the Crypto Market

The Genesis GBTC sell-off, while significant, is but one of many factors that influence the cryptocurrency market. Coinbase’s analysis provides a calming perspective, highlighting several key takeaways:

- Market Resilience: The crypto market’s ability to balance out after such events is a testament to its inherent resilience and the growing sophistication of its participants.

- Importance of Institutional Support: The continued interest and investment from institutional players are crucial for the long-term stability and growth of the cryptocurrency market.

- Focus on Fundamentals: Events like the Genesis GBTC sell-off underscore the importance of focusing on the fundamental drivers of the cryptocurrency market, rather than reacting to short-term market movements.

Conclusion

The Genesis GBTC sell-off presents both challenges and opportunities for the cryptocurrency market. Coinbase’s analysis offers a balanced perspective, suggesting that the market will eventually balance out, bolstered by its resilience, institutional interest, and strong fundamentals. For investors and enthusiasts alike, maintaining a long-term outlook and focusing on the underlying strengths of the cryptocurrency ecosystem will be key to navigating the current market dynamics. As the market continues to mature, it will undoubtedly face further tests, but the collective confidence in the cryptocurrency vision and its foundational technologies will continue to drive progress and innovation.