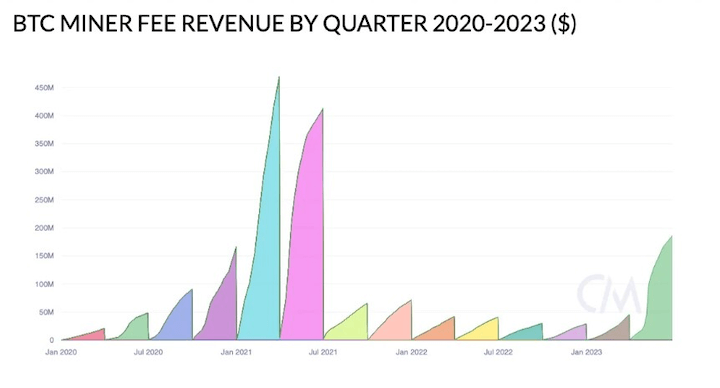

In a surprising turn of events, Bitcoin miners have reaped massive rewards during the second quarter of 2023, surpassing the total fees earned in the previous year. The cryptocurrency world is buzzing with excitement as miners celebrate this unprecedented windfall. With Bitcoin’s value surging and transaction volumes reaching new heights, the stage was set for a lucrative period for those involved in mining operations.

Unveiling the Breaking Figures

Bitcoin miners have emerged as the clear winners in the second quarter of 2023, with earnings skyrocketing to a staggering $184 million in fees alone. That surpasses the cumulative fees miners earned throughout 2022, underscoring the extraordinary growth experienced in recent months. The magnitude of this increase underscores the expanding role of miners and their critical position within the Bitcoin network.

The Factors Driving the Surge

Several key factors have converged to facilitate this remarkable achievement by Bitcoin miners. Understanding these dynamics is essential to comprehending the underlying forces behind this astronomical fee generation.

- Bitcoin’s Price Surge: Bitcoin’s market value substantially surged during the second quarter, reaching new all-time highs. As the price of Bitcoin soared, so did the value of transaction fees associated with mining. Higher fees accompany larger transaction volumes, reflecting the increased demand for Bitcoin transactions and the resulting congestion in the network.

- Rising Transaction Volumes: The number of transactions on the Bitcoin network has increased. This surge in volume can be attributed to various factors, including increased adoption, growing interest from institutional investors, and wider acceptance of cryptocurrencies as a legitimate form of payment. The increased transaction volume directly correlates to a surge in fees for miners.

- Network Congestion: As transaction volumes soared, the Bitcoin network experienced periods of congestion. This congestion and limited block space forced users to bid higher fees to ensure their transactions were included in a block promptly. Capitalizing on this bottleneck, Miners reaped the benefits of elevated fee levels.

Implications for the Cryptocurrency Ecosystem

The surge in fees earned by Bitcoin miners carries broader implications for the cryptocurrency ecosystem, particularly regarding network scalability, transaction efficiency, and the sustainability of mining operations.

- Scalability Challenges: The surge in fees highlights the need for continued efforts to address the scalability challenges the Bitcoin network faces. While the Lightning Network and other layer-two solutions aim to alleviate congestion, further innovation and improvements are necessary to accommodate the growing demand and maintain reasonable fee levels.

- Transaction Efficiency: Higher fees may lead to delays in confirming transactions for users who are unwilling or unable to pay the premium. As a result, the cryptocurrency community will need to explore alternative solutions to enhance transaction efficiency and reduce reliance on exorbitant fees.

- Mining Industry Growth: The unprecedented earnings of Bitcoin miners in Q2 underscores the growing significance and profitability of mining operations. That could attract more participants to the mining industry, contributing to increased competition and potential consolidation among mining pools. Miners must balance profitability with the long-term sustainability of the network.

Conclusion

Bitcoin miners have hit the jackpot, amassing an astounding $184 million in fees during the second quarter of 2023, surpassing the total fees earned in the preceding year. This milestone serves as a testament to the surging popularity of Bitcoin, accompanied by increasing transaction volumes and a soaring market value. However, it also exposes scalability and transaction efficiency challenges, calling for continuous innovation and improvements to maintain a healthy cryptocurrency ecosystem. As the Bitcoin network continues to evolve and assert its dominance, we can be sure that the crypto community can overcome ongoing challenges within the cryptocurrency landscape.