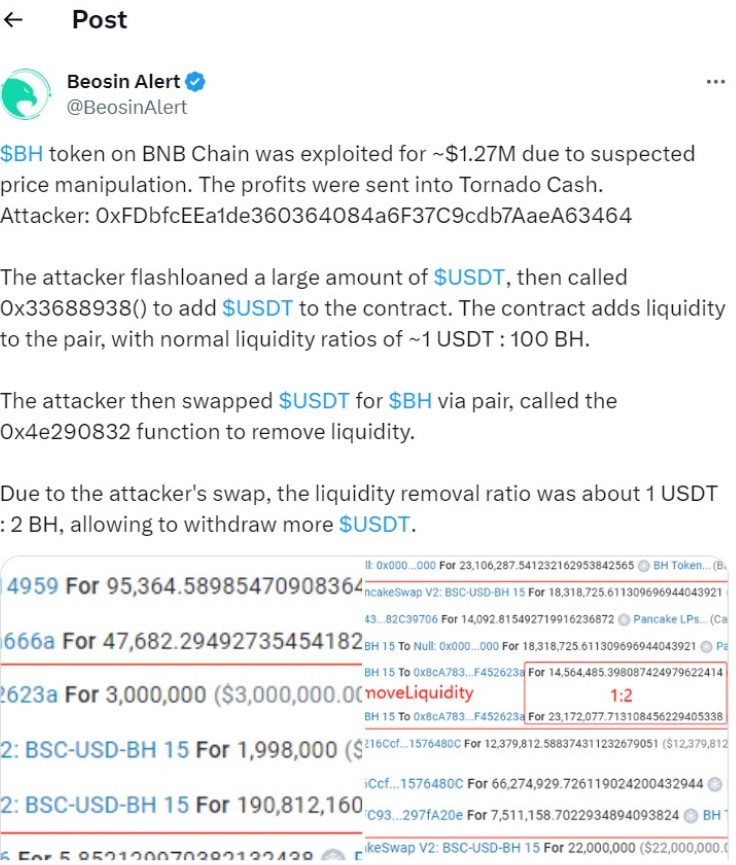

The decentralized world of cryptocurrency is both a playground for innovation and a breeding ground for nefarious exploits. In a recent incident, an attacker identified as 0xFDbfcEEa1de360364084a6F37C9cdb7AaeA63464 managed to exploit the $BH token on the Binance Smart Chain (BNB) and walked away with a staggering $1.27 million in USDT.

The attacker’s clever maneuver involved a combination of flashloans, price manipulation, and some well-timed moves within the DeFi ecosystem.

Flashloans and the $USDT Surge

The attacker’s first step in the audacious heist was to execute a flashloan operation, borrowing a substantial amount of the USDT token. Flashloans allow users to borrow significant sums of cryptocurrency without collateral, provided the borrowed amount is returned within the same transaction. This tactic gave the attacker a massive war chest to work with.

Adding $USDT to the Contract

Once armed with the borrowed USDT, the attacker initiated the exploitation. By calling the function 0x33688938(), the attacker added a significant amount of USDT to the $BH token’s smart contract. This influx of liquidity tilted the balance within the contract, setting the stage for further manipulation.

Liquidity Ratio Manipulation

The attacker’s next move was to engage in liquidity ratio manipulation. The standard liquidity ratio for this contract was approximately 1 USDT for every 100 BH tokens. However, the attacker, with their significant USDT holdings, was able to swap USDT for $BH tokens via the contract’s liquidity pool. This led to a deviation from the standard ratio, bringing it to about 1 USDT for every 2 BH tokens.

Price Manipulation and Profit Extraction

The altered liquidity ratio set the stage for price manipulation. With the liquidity pool now skewed, the attacker was able to take advantage of the altered pricing and exchange rates. As a result, the attacker was able to withdraw more USDT than they had initially contributed to the pool.

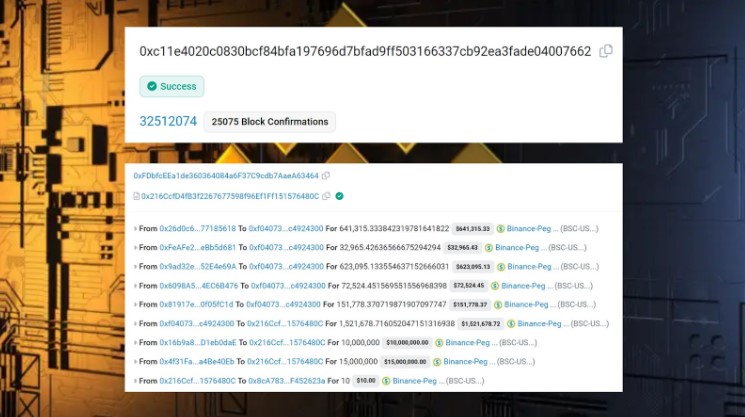

In the end, the manipulation of the pool resulted in the attacker receiving approximately $1.57 million USDT more than they had originally put in. The ill-gotten gains were then converted back into the $BH token, which the attacker promptly sold. This allowed them to repay the initial flashloan and pocket a jaw-dropping profit of $1.27 million in USDT.

A Mere $4 Transaction Fee

What’s even more astounding is the transaction fee for this entire operation. The attacker managed to pull off this complex heist while paying a mere $4 in BNB transaction fees. This not only showcases the capabilities of DeFi and flashloans but also raises questions about the security and vulnerability of smart contracts in the decentralized ecosystem.

Conclusion

The $1.27 million heist involving the $BH token on the Binance Smart Chain is a stark reminder of the risks and vulnerabilities that exist in the world of decentralized finance. With the ability to execute flashloans and manipulate liquidity ratios, malicious actors can exploit price discrepancies and profit at the expense of others.

You might also be interested: Web3 Alert: Q3 2023 Records $889.26M in Losses

This incident highlights the importance of complex and rigorous security audits and comprehensive testing of smart contracts in DeFi projects. It also underscores the need for constant vigilance within the crypto community to detect and thwart such attacks promptly.

It is essential for developers, users, and the broader community to work together to improve the security of these platforms. The $BH token heist serves as both a cautionary tale and a call to action for the crypto industry to shore up its defenses and protect the assets of all participants.