Bitfinex, a prominent cryptocurrency exchange, recently launched the Bitfinex Securities platform, introducing tokenized assets known as Real World Assets (RWA). Among these offerings, Bitfinex announced the issuance of its bonds, ALT2611, denominated in USDT, with a 36-month maturity and an enticing yield of 10%.

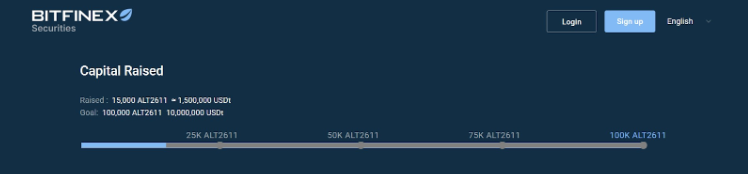

Tether, a key player in the cryptocurrency space, participated in the launch, envisioning traditional USDT-denominated instruments as foundational elements in a new financial system. However, Bitfinex’s ambitious goal of selling 100,000 bonds worth 10 million USDT in two weeks faced a substantial setback, with investors only purchasing 15,000 bonds amounting to 1.5 million USDT.Discover other important news: Binance’s Q3 2023 Report

- Bitfinex’s Foray into Tokenized Bonds: The Launch of Bitfinex Securities

- Tether’s Participation: Elevating USDT-Denominated Instruments

- High Expectations, Limited Results: Bitfinex Falls Short of Bond Sale Targets

- Challenges in Adoption: Unpacking the Limited Investor Interest

- Looking Ahead: Bitfinex’s Next Steps and the Future of Tokenized Bonds

- Lessons Learned and Paths Forward for Tokenized Finance

Bitfinex’s Foray into Tokenized Bonds: The Launch of Bitfinex Securities

To diversify its offerings and explore new avenues in the crypto finance realm, Bitfinex introduced the Bitfinex Securities platform, designed specifically for trading tokenized assets or Real World Assets (RWA). Capitalizing on the growing interest in tokenization, Bitfinex aimed to revolutionize traditional financial instruments by issuing its own tokenized bonds, ALT2611. These bonds, denominated in Tether (USDT), promised a 36-month maturity and an enticing yield of 10%.

Tether’s Participation: Elevating USDT-Denominated Instruments

Tether, a stablecoin pegged to the value of the US dollar, actively participated in the launch of Bitfinex’s tokenized bonds. The collaboration was driven by the shared vision that traditional USDT-denominated instruments could be pivotal in shaping a new financial system within the cryptocurrency ecosystem. The involvement of Tether added weight to Bitfinex’s endeavor, highlighting the potential synergy between established stablecoins and emerging tokenized financial instruments.

High Expectations, Limited Results: Bitfinex Falls Short of Bond Sale Targets

Despite high expectations and ambitious projections, Bitfinex faced a notable challenge in selling its tokenized bonds. The exchange anticipated selling 100,000 bonds, equivalent to 10 million USDT, within two weeks.

However, the actual results fell significantly short, with investors purchasing only 15,000 bonds, amounting to 1.5 million USDT. The discrepancy between projections and actual sales prompts a deep examination of the factors leading to this unexpected outcome.

Challenges in Adoption: Unpacking the Limited Investor Interest

The limited success in selling tokenized bonds raises questions about investor interest and confidence in such offerings. Factors such as market sentiment, perceived risks associated with tokenized assets, and the relatively nascent nature of this financial instrument likely played a role in deterring potential buyers. Additionally, the ambitious sales target set by Bitfinex may have created a mismatch between expectations and the market’s readiness for such innovative financial products.

Looking Ahead: Bitfinex’s Next Steps and the Future of Tokenized Bonds

As Bitfinex grapples with the challenges of limited bond sales, the exchange’s next steps become crucial in shaping the narrative around tokenized bonds. The company’s ability to reassess and adapt its strategy, address concerns raised by the market, and educate potential investors on the benefits of tokenized assets will be pivotal in influencing future adoption. The outcome of Bitfinex’s experience could also serve as a valuable lesson for other players in the crypto space, eyeing tokenization as a transformative force in the financial landscape.

Lessons Learned and Paths Forward for Tokenized Finance

Bitfinex’s venture into tokenized bonds and the subsequent challenges in achieving sales targets offer valuable insights into the evolving landscape of tokenized finance. The gap between expectations and reality emphasizes the importance of aligning innovative financial instruments with market readiness and investor sentiment. As the cryptocurrency industry continues to explore the potential of tokenization, the experiences of pioneers like Bitfinex provide essential lessons for refining strategies and fostering the gradual adoption of novel financial products in the broader market.