In the ever-evolving landscape of cryptocurrencies, Starknet’s STRK token has recently found itself at the center of a tumultuous storm. Once hailed as a promising project with potential, its value has now taken a nosedive, leaving investors bewildered and shaken. What triggered this sudden downfall? Dive deeper with us into the heart of the matter as we uncover the events leading to Starknet’s struggle and the implications for the broader crypto community.

The Rise and Fall of Starknet

Starknet emerged onto the scene amidst much fanfare, promising to revolutionize decentralized applications (dApps) with its innovative solutions. Leveraging stark proofs, the project aimed to provide scalability and privacy while maintaining the security inherent in blockchain technology. Investors flocked to the project, drawn by its ambitious vision and the prospect of significant returns.

For a time, Starknet seemed poised for success, with its STRK token gaining traction and garnering attention within the crypto sphere. However, cracks began to surface as issues surrounding governance and scalability plagued the project. Despite efforts to address these concerns, confidence waned, and skepticism crept in.

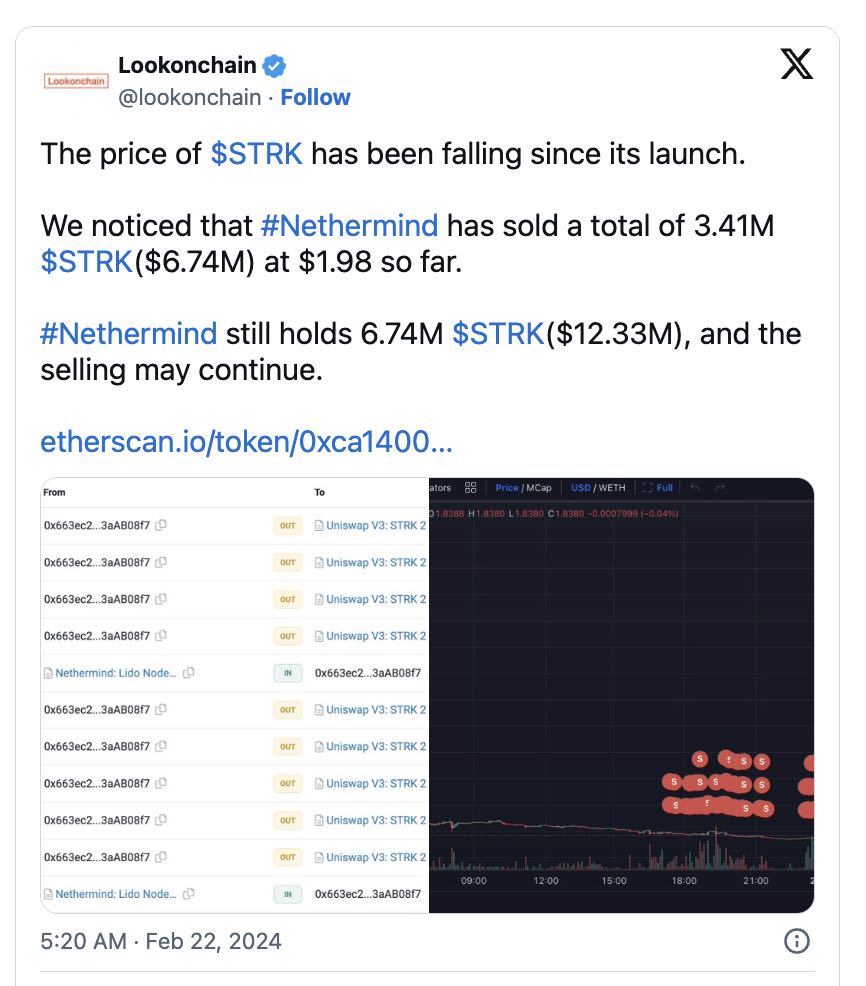

The Nethermind Sell-off

The first blow to Starknet’s stability came with the unexpected sell-off by Nethermind, a prominent player in the crypto space. Known for its contributions to Ethereum and other blockchain projects, Nethermind’s decision to divest its holdings in STRK sent shockwaves through the market. Analysts speculated on the motives behind the move, with some attributing it to a loss of faith in Starknet’s long-term viability.

The sell-off triggered a chain reaction, as other investors followed suit, eager to cut their losses and salvage what they could. The ensuing flood of sell orders inundated the market, driving down the price of STRK and exacerbating the situation.

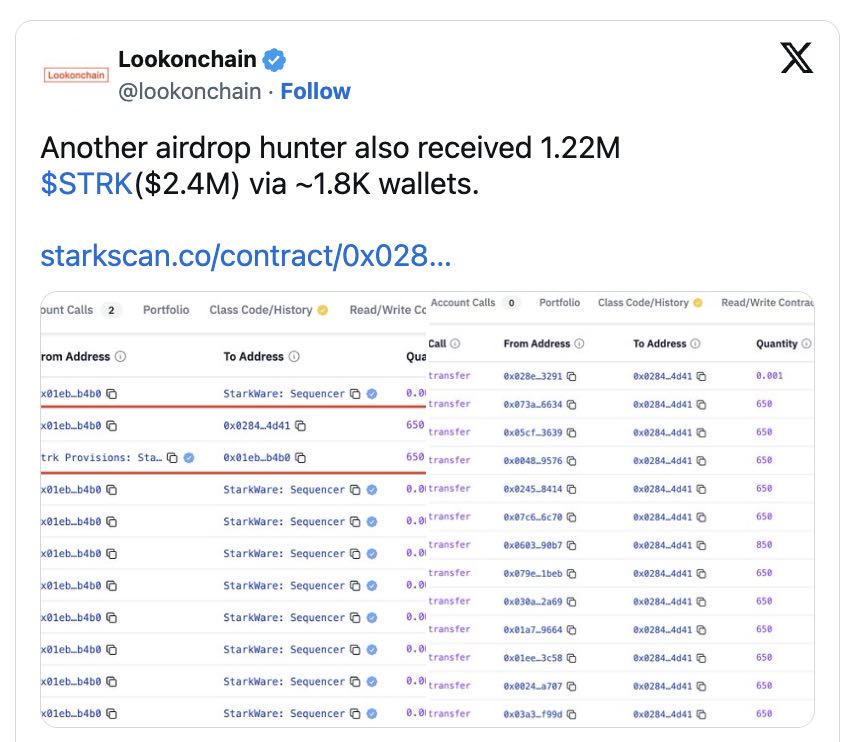

Airdrop Hunters Add to the Pressure

As if the Nethermind sell-off wasn’t enough, Starknet faced another challenge in the form of airdrop hunters looking to cash in on free tokens. With rumors swirling about an upcoming airdrop, opportunistic traders swooped in, hoping to capitalize on the anticipated giveaway.

While airdrops can be a valuable tool for distributing tokens and fostering community engagement, the prospect of free tokens proved to be a double-edged sword for Starknet. As speculators flooded the market, eager to offload their tokens at the earliest opportunity, the price of STRK plummeted further, leaving genuine investors reeling.

The Aftermath and Implications

In the wake of these developments, Starknet finds itself at a crossroads, grappling with existential questions about its future. The once-promising project now faces an uphill battle to regain trust and credibility within the crypto community. Rebuilding confidence will require transparency, effective communication, and concrete steps to address the underlying issues that led to its downfall.

The saga of Starknet serves as a cautionary tale for investors and projects alike, highlighting the inherent volatility and unpredictability of the crypto market. While opportunities for profit abound, so too do risks and uncertainties. As stakeholders navigate these turbulent waters, they must exercise due diligence and vigilance to safeguard their investments and support projects with genuine potential for long-term success.

Conclusion

The decline of Starknet’s STRK token underscores the fragility of the crypto ecosystem and the importance of robust fundamentals in sustaining value over time. As the dust settles and the crypto community reflects on this episode, lessons will be learned, and new insights gained. Whether Starknet can weather the storm and emerge stronger remains to be seen, but one thing is certain: the journey ahead will be fraught with challenges and opportunities aplenty.