In a startling revelation, the U.S. Securities and Exchange Commission (SEC) has linked a recent high-profile hack of account X to a sophisticated ‘SIM swap’ attack, occurring just before the official approval of a Bitcoin Exchange-Traded Fund (ETF). This incident not only underscores the growing cybersecurity threats in the digital finance realm but also raises critical questions about the safety and security of digital assets as they gain mainstream acceptance.

Understanding the SIM Swap Attack on Account X

A SIM swap attack is a malicious maneuver where a hacker gains control of a victim’s mobile phone number by convincing the carrier to switch the number to a SIM card in their possession. In the case of account X, this technique enabled hackers to bypass security measures, access sensitive financial information, and potentially impact the market movements just before the landmark decision on Bitcoin ETFs.

SEC’s Response and the Implications for Digital Security

The SEC’s acknowledgment of the SIM swap attack is a sobering reminder of the vulnerabilities that exist even in reputedly secure digital accounts. It has prompted a reassessment of security protocols, especially in the context of significant financial events like the approval of Bitcoin ETFs. The incident highlights the need for enhanced security measures, both from individual users and institutions, to safeguard against such sophisticated attacks.

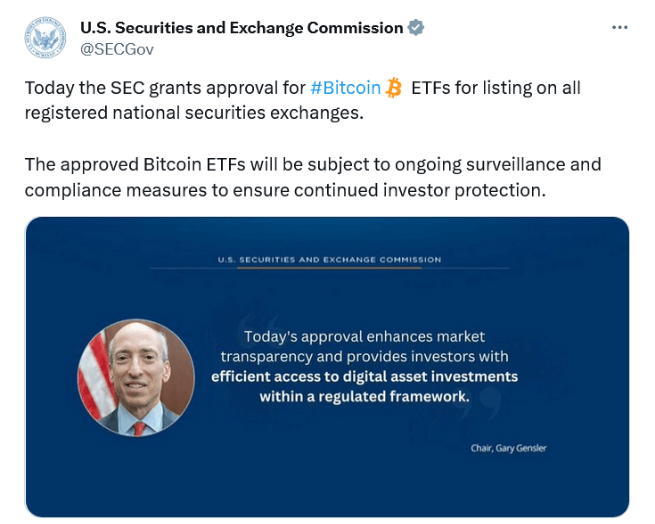

The Bitcoin ETF Approval and Market Sensitivities

The timing of the attack – just prior to the SEC’s approval of a Bitcoin ETF – is particularly noteworthy. Bitcoin ETFs represent a significant step towards the integration of cryptocurrencies into conventional financial systems. However, this incident illustrates how market-sensitive information can be compromised, potentially leading to unfair advantages or market manipulation.

Moving Forward: Strengthening Cybersecurity in the Financial Sector

In response to this incident, there’s a growing call for stricter cybersecurity measures and more robust regulatory frameworks to protect digital assets. The financial sector, particularly entities dealing with cryptocurrencies and related products like ETFs, must prioritize advanced security technologies and awareness to mitigate such risks.

Conclusion

The recent SIM swap attack on account X, highlighted by the SEC, serves as a critical wake-up call to the cryptocurrency and financial communities. As digital assets like Bitcoin become more entwined with traditional financial products, the imperative for stronger, more resilient cybersecurity measures has never been greater. Coinhackz.com will continue to follow this developing story, providing insights and updates on the evolving landscape of digital finance security.