In a landmark decision reverberating through cryptocurrency history’s annals, the US Court of Appeals confiscated 69,000 BTC associated with the infamous Silk Road darknet marketplace. This gripping tale unfolds from the marketplace’s inception by Ross Ulbricht in 2011 to the recent court ruling that officially brings the saga to a decisive turning point.

The Genesis: Silk Road’s Darknet Empire

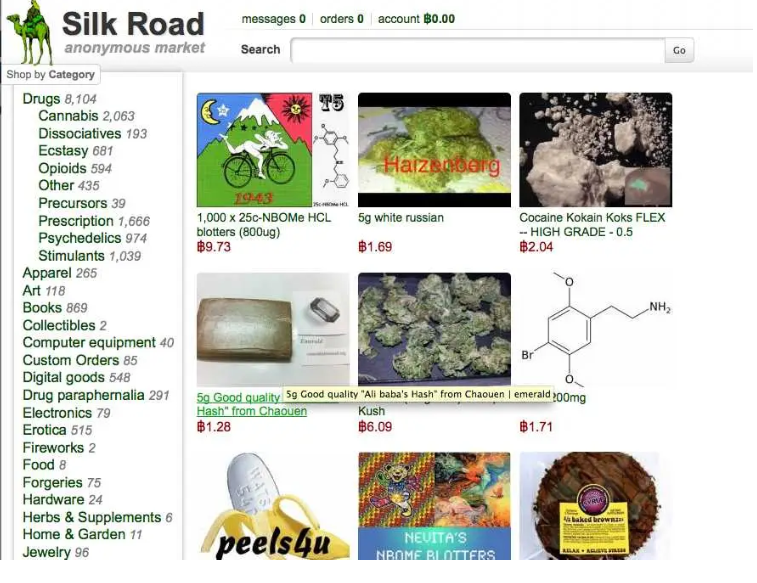

Silk Road, a darknet marketplace that emerged in 2011, quickly became synonymous with illicit activities and the shadowy underbelly of the internet. The platform, founded by Ross Ulbricht, facilitated the anonymous trade of goods and services using cryptocurrency, primarily Bitcoin (BTC). Two years into its operation, the empire crashed when Ulbricht was arrested in 2013.

In 2015, the US court delivered a severe blow to Ulbricht, sentencing him to two life terms with the confiscation of Silk Road’s assets, including a substantial amount of Bitcoin. The court’s decision marked the end of an era for Silk Road but ignited a new chapter in the legal battles surrounding its cryptocurrency holdings.

Cryptocurrency Confiscation Conundrum: Ulbricht’s 69,000 BTC

Following Ulbricht’s sentencing, the Ministry of Justice possessed 69,000 BTC linked to the Silk Road. However, the legal landscape posed a complex challenge — liquidating the cryptocurrency required a court order. For years, these Bitcoins remained in limbo, representing a significant portion of the cryptocurrency assets associated with Silk Road.

The unique nature of cryptocurrency assets introduced novel challenges for the Ministry of Justice. Unlike traditional assets, the liquidation of Bitcoin required legal clarity and a court-approved pathway. The legal system grappled with the intricacies of navigating the digital realm to bring closure to the Silk Road saga.

August 2023: The Turning Point in Silk Road’s Legacy

In a pivotal moment that unfolded in August 2023, the district court of appeals decided to confiscate the 69,000 BTC linked to Silk Road fully. This decision opened the possibility of selling the seized Bitcoins, finally providing a legal avenue for the US government to dispose of the cryptocurrency assets.

The district court’s decision marked a turning point, resolving the legal complexities surrounding the Silk Road’s cryptocurrency holdings. With the confiscation officially sanctioned, the US government holds a substantial cache of about 200,000 BTC, valued at $8.8 billion.

The Broader Implications: Government’s Cryptocurrency Holdings

Beyond the Silk Road narrative, the US government’s possession of approximately 200,000 BTC underscores the evolving relationship between legal systems and cryptocurrency assets. As the digital currency landscape matures, governments worldwide grapple with the regulatory frameworks needed to address the complexities of cryptocurrency ownership and liquidation.

The Silk Road’s cryptocurrency saga reflects a broader global conversation on how legal systems interact with and regulate cryptocurrency assets. The burgeoning value of these digital holdings raises questions about the potential impact on national finances and the necessity for comprehensive legal frameworks.

Discover more! Coinbase Takes SEC to Court

Silk Road’s Legacy and Cryptocurrency’s Legal Frontiers

The US Court of Appeals confiscation of 69,000 BTC associated with the Silk Road darknet marketplace marks a historic milestone in the evolving narrative of cryptocurrency and the law.

This landmark decision not only signifies the closure of the Silk Road saga but also prompts a broader reflection on the legal frontiers that governments must navigate in the dynamic realm of cryptocurrency. As the story unfolds, the legacy of Silk Road becomes intertwined with the ongoing conversation about the future of cryptocurrency regulation and governance.