Paxos, a trusted name in the blockchain industry, has received regulatory approval to issue its stablecoin, USDP, on the Solana blockchain. With an anticipated launch date as early as January 17, 2024, this move marks a transformative moment in decentralized finance.

Regulatory Green Light for Paxos

Paxos, a US-based company, has navigated the regulatory landscape successfully, obtaining approval from the New York State Department of Financial Services to launch its stablecoin, USDP, on Solana. This regulatory clearance is a testament to Paxos’s commitment to compliance and adherence to stringent financial standards. The NYDFS’s stamp of approval positions Paxos as a reliable player in the stablecoin arena, paving the way for further adoption and integration within the broader financial ecosystem.

USDP on Solana: A Game-Changing Venture

With the regulatory hurdles cleared, Paxos is set to launch USDP on the Solana blockchain, adding a new dimension to the decentralized finance space. Solana, known for its high throughput and low transaction fees, provides an ideal environment for the seamless operation of stablecoins. The anticipated debut of USDP on Solana signifies a strategic move to leverage the efficiency and scalability offered by the Solana blockchain, enhancing the overall user experience in the stablecoin ecosystem.

Capitalization and Market Impact

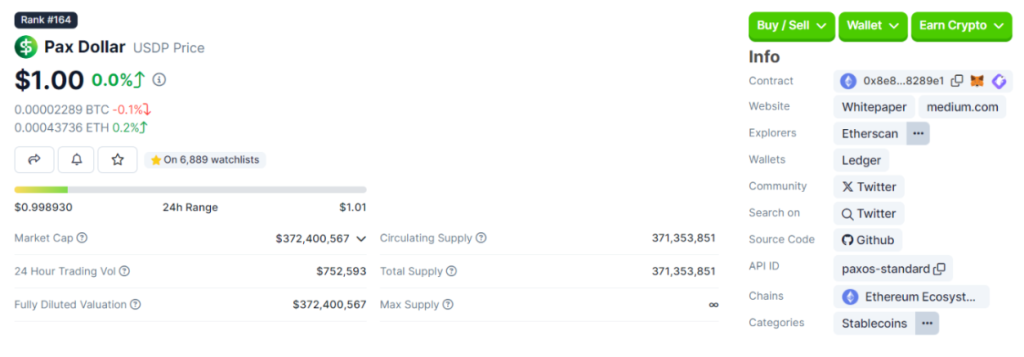

Currently, USDP boasts a capitalization of $369 million, indicating a robust market presence even before its introduction on the Solana blockchain. This capitalization reflects the confidence and interest that the cryptocurrency community has in Paxos and its stablecoin offerings. The upcoming launch on Solana is poised to amplify USDP’s market impact further, potentially influencing the broader stablecoin landscape.

A Glimpse into the Future: PYUSD on Solana?

The Fortune report suggests the possibility of PYUSD, PayPal’s stablecoin, appearing on the Solana blockchain soon. While this speculation adds an element of anticipation, it also underscores the attractiveness of Solana as a preferred platform for stablecoin issuances. The convergence of established financial entities like PayPal with innovative blockchain solutions signifies a collaborative approach toward shaping the future of digital finance.

Extra: Tether VS Paxos

In contrast to Paxos, Tether operates in a different regulatory landscape. As a registered offshore entity, Tether is subject to the Ministry of Finance for anti-money laundering policy matters. This unique position allows Tether to issue USDT on new blockchains without seeking explicit permission from regulators, presenting a different dynamic in the stablecoin ecosystem.

Paving the Way for Stablecoin Innovation

Paxos’s regulatory approval to issue USDP on Solana marks a pivotal moment in the journey of stablecoins. The convergence of regulatory compliance, technological innovation, and market demand sets the stage for a new era in decentralized finance.

Discover other stories! Binance Establishes New Headquarters

As Paxos takes the lead and the potential arrival of PYUSD on Solana looms on the horizon, the cryptocurrency community eagerly anticipates the unfolding narrative, recognizing the pivotal role stablecoins play in shaping the future of digital transactions and financial inclusivity.