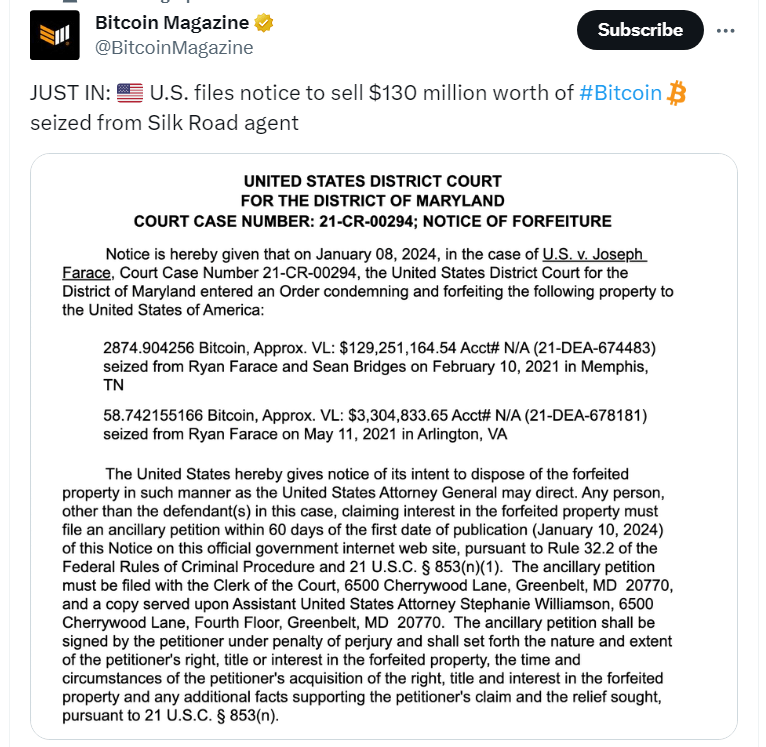

In a significant development in the cryptocurrency world, the U.S. government has filed a notice to auction off approximately $130 million worth of Bitcoin. These assets were seized from a former Silk Road agent, marking yet another chapter in the government’s foray into cryptocurrency confiscations. In this article, we’ll explore the details surrounding this auction, its implications, and what it signifies for the broader crypto landscape.

The Silk Road Legacy

Silk Road, the infamous darknet marketplace, was known for facilitating illegal transactions using Bitcoin as the preferred method of payment. Over the years, authorities have seized substantial amounts of Bitcoin related to Silk Road activities.

Seizure and Legal Proceedings

The Bitcoin assets in question were seized as part of legal proceedings against a former Silk Road agent. The U.S. government’s pursuit of illicit cryptocurrency holdings reflects its commitment to combating illegal activities within the digital asset space.

Auctioning Cryptocurrency Assets

Auctioning off confiscated cryptocurrency assets has become a common practice for governments worldwide. It serves as a means to liquidate seized funds while contributing to the government’s coffers. These auctions provide an opportunity for interested buyers to acquire Bitcoin through legitimate means.

Impact on the Cryptocurrency Market

The auction of such a significant amount of Bitcoin can have ripple effects on the cryptocurrency market. It may temporarily increase supply, potentially influencing market dynamics and prices. Observers will closely monitor how this influx of Bitcoin impacts market sentiment.

Regulatory Significance

The U.S. government’s actions highlight the evolving regulatory landscape for cryptocurrencies. It underscores the need for robust compliance measures within the crypto industry to ensure adherence to legal and regulatory standards.

Investor Interest

Auctions of seized cryptocurrency assets often attract the attention of institutional and retail investors looking to acquire Bitcoin through legitimate channels. This auction presents an opportunity for those interested in diversifying their crypto holdings.

Conclusion

The U.S. government’s decision to auction approximately $130 million worth of Bitcoin seized from a Silk Road agent underscores its commitment to enforcing cryptocurrency-related regulations. As the cryptocurrency market matures, interactions between authorities and the digital asset space will continue to shape the industry’s landscape. This auction serves as a reminder of the government’s presence in the crypto realm and its dedication to maintaining legal compliance.