The Litecoin blockchain, one of the pioneers in the cryptocurrency space, recently completed its third halving event, marking a significant milestone in its journey. The halving reduced miner rewards from 12.5 LTC to 6.25 LTC. This event has sparked considerable interest and anticipation among stakeholders, leading to increased volatility in LTC prices. This article explores the implications of Litecoin’s halving and its potential impact on mass adoption and network security.

Halving: A Crucial Event

The halving, a pre-programmed and crucial event in the Litecoin protocol, occurs approximately every four years. It is designed to curb inflation and limit the supply of new coins entering circulation. As a result of the recent halving, the number of LTC issued to miners for validating transactions and maintaining the network has been cut in half, from 12.5 LTC to 6.25 LTC per block.

Anticipation and Volatility

Leading up to the halving, the social dominance of Litecoin experienced a surge, with enthusiasts and investors eagerly discussing the event’s potential impact. However, this surge in interest also led to increased anxiety among stakeholders. Uncertainty regarding LTC’s price direction post-halving created a volatile market as traders tried to anticipate the future value of the digital asset.

Founder’s Vision: Mass Adoption and Network Security

Charlie Lee, the founder of Litecoin, has been vocal about the significance of the halving for the cryptocurrency’s long-term growth. He believes that the event helps control inflation and plays a crucial role in promoting mass adoption. Litecoin’s scarcity is emphasized by reducing the block subsidy, potentially leading to increased demand and higher valuations.

Lee also highlights the importance of network security. Fewer coins issued to miners incentivize them to continue supporting the network and maintaining its integrity. Reducing miner rewards could strengthen the overall security of the Litecoin blockchain, making it more resilient against potential attacks.

Challenges and Market Impact

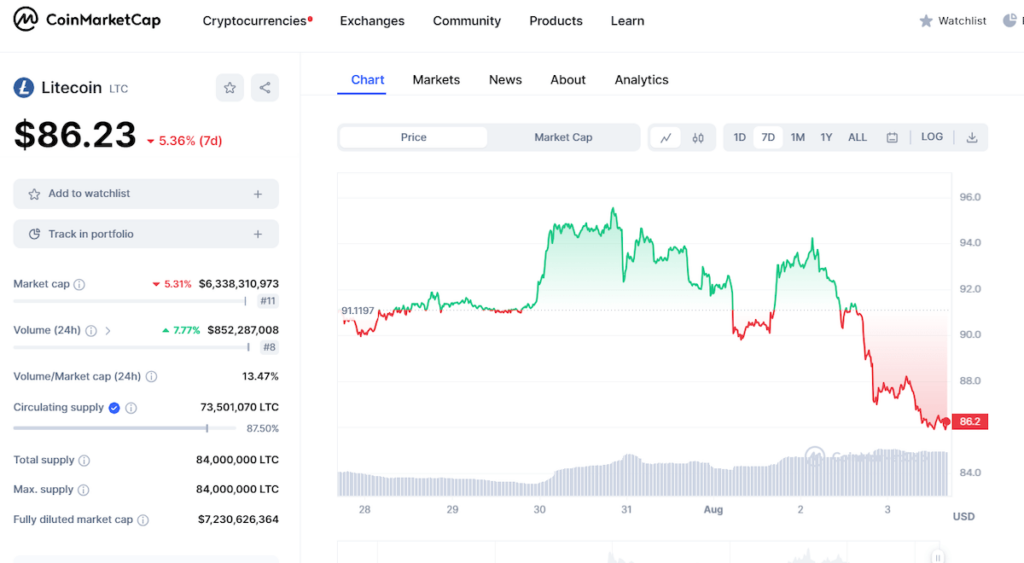

Despite the positive outlook, the immediate aftermath of the halving has been met with challenges. LTC prices have shown volatility, and stakeholders are finding it difficult to navigate the current market conditions. In the days following the halving, LTC’s price has already declined by around 5.6%, and there is potential for further losses as the market adjusts to the reduced block rewards.

Additionally, the increase in selling activities adds further downward pressure on the declining price. Some miners might offload their newly mined coins to cover operational expenses, contributing to short-term sell-offs. However, it’s worth noting that these challenges are typical during halving events, and the market’s volatility is expected to stabilize in the long run.

Conclusion

The completion of Litecoin’s third halving has set the stage for a new chapter in the cryptocurrency’s history. With the block subsidy reduced from 12.5 LTC to 6.25 LTC, the Litecoin network is poised for enhanced scarcity, potential mass adoption, and improved security. While short-term volatility has challenged stakeholders, the long-term prospects for Litecoin remain optimistic. As the market adapts to the halving’s impact, the true value of Litecoin’s robust blockchain technology and the vision of its founder, Charlie Lee, are likely to shine through.

Previously, we reported on how Aave Ethereum V2 Disabled CRV Borrowing Function To Prevent Curve Vulnerability Exploitation. Stay with us for more updates and news about blockchain and cryptos!