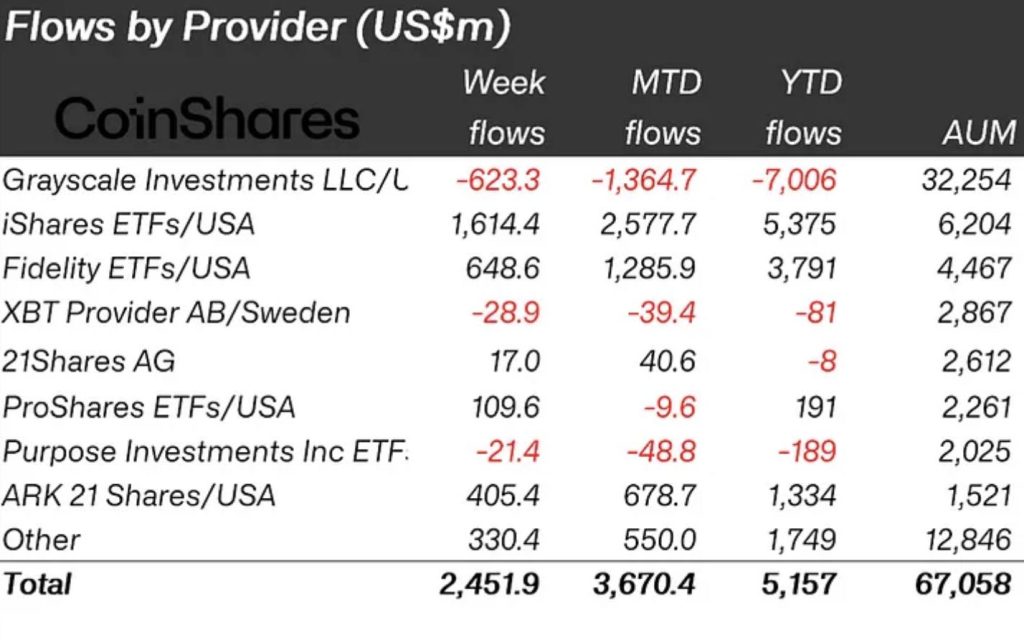

In a remarkable testament to the burgeoning strength and growing acceptance of digital currencies, crypto exchange-traded products (ETPs) have soared to unprecedented bull run levels, amassing an astounding $67 billion in assets under management (AUM). This significant milestone not only underscores the heightened investor interest in cryptocurrency as a legitimate asset class but also highlights the evolving dynamics of the global financial landscape. As the crypto market continues to mature, the surge in ETPs AUM signals a pivotal shift towards mainstream financial integration. Coinhackz.com delves into the factors driving this phenomenal growth, the implications for the crypto ecosystem, and what this means for both seasoned investors and newcomers to the digital currency space.

The Catalysts Behind the Surge

Several key factors have contributed to the remarkable ascent of crypto ETPs to bull run levels:

- Institutional Adoption: A growing number of institutional investors are turning to crypto ETPs as a secure and regulated avenue to gain exposure to digital currencies. This shift is largely fueled by the desire to diversify investment portfolios and capitalize on the high return potential of cryptocurrencies.

- Regulatory Clarity: Enhanced regulatory clarity in various jurisdictions has played a crucial role in legitimizing crypto ETPs as a viable investment vehicle. As regulators continue to provide guidance and frameworks for the operation of these products, investor confidence has surged, leading to increased allocations to crypto ETPs.

- Innovation in Product Offerings: The crypto ETP market has seen a proliferation of innovative products designed to cater to diverse investor needs, including those based on specific cryptocurrencies, sectors within the blockchain ecosystem, and strategies such as passive and active management. This variety has attracted a broader spectrum of investors, contributing to the growth in AUM.

Implications for the Crypto Ecosystem

The exponential growth in the AUM of crypto ETPs carries significant implications for the broader cryptocurrency ecosystem:

- Mainstream Acceptance: The success of crypto ETPs is a clear indicator of cryptocurrency’s increasing acceptance among mainstream investors, potentially paving the way for more widespread adoption of digital currencies.

- Market Stability: The infusion of institutional capital into the crypto market via ETPs could contribute to greater market stability and liquidity, mitigating some of the volatility traditionally associated with cryptocurrencies.

- Innovation and Competition: As more players enter the crypto ETP space, competition will likely drive further innovation, leading to the development of more sophisticated and diverse product offerings. This could enhance the attractiveness of crypto investments and foster greater market maturity.

Looking Ahead: A New Era for Crypto Investments

The landmark achievement of $67 billion in AUM for crypto ETPs marks the beginning of a new era for cryptocurrency investments. As the market continues to evolve, the role of crypto ETPs will undoubtedly become increasingly central to the broader financial ecosystem. Investors, both institutional and retail, are likely to benefit from the enhanced accessibility, security, and diversity of investment options afforded by these products.

Conclusion

The surge in assets under management for crypto exchange-traded products to bull run levels is a momentous development that underscores the vibrant growth and potential of the cryptocurrency market. As crypto ETPs continue to attract significant investment, they serve as a bridge connecting the innovative world of digital currencies with the traditional financial system. This alignment not only facilitates easier access to crypto investments but also heralds a future where cryptocurrencies are an integral part of diversified investment portfolios. As we witness this historic growth trajectory, the future of crypto ETPs and their impact on the global financial landscape remains a compelling narrative to watch unfold.