In a significant development that has caught the attention of the crypto community, the IRS (Internal Revenue Service) has taken a step back in its approach to cryptocurrency taxation. The latest decision brings relief to many crypto enthusiasts and investors. In this article, we delve into the details of the IRS’s move to exempt cryptocurrency transactions exceeding $10,000 from certain tax obligations.

Background: Cryptocurrency Taxation Challenges

Cryptocurrency taxation has been a complex and evolving issue for both individuals and regulators. The IRS has been actively seeking ways to ensure compliance and transparency in the crypto space.

The IRS’s Previous Stance: Reporting for All Transactions

Until recently, the IRS required individuals to report all cryptocurrency transactions, regardless of the transaction amount. This included activities like buying, selling, and transferring cryptocurrencies, creating a substantial reporting burden for users.

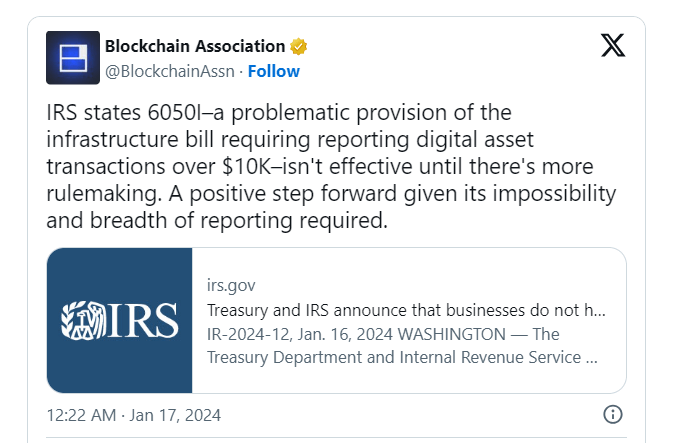

The New Exemption: Transactions Over $10,000

The IRS’s latest decision introduces a significant change. Transactions involving cryptocurrencies that exceed $10,000 are now exempt from certain tax obligations. This means that individuals will not be required to report these transactions for tax purposes.

Implications for the Crypto Community

The IRS’s move has been met with mixed reactions within the crypto community. While it eases the reporting burden for larger transactions, it also raises questions about the broader regulatory landscape.

Simplifying Reporting: A Positive Step

Proponents of the exemption argue that it simplifies reporting for users and reduces the administrative burden on both individuals and the IRS. It acknowledges that smaller transactions may not pose the same tax compliance risks as larger ones.

Remaining Tax Obligations

It’s important to note that while the reporting threshold for certain transactions has increased, other tax obligations, such as capital gains reporting, remain in place. Individuals are still required to report cryptocurrency gains and losses.

Conclusion: A Shift in Crypto Taxation

The IRS’s decision to exempt cryptocurrency transactions exceeding $10,000 from specific tax obligations marks a notable shift in the taxation of digital assets. As the crypto regulatory landscape continues to evolve, it is essential for individuals to stay informed and ensure compliance with the latest rules and exemptions.