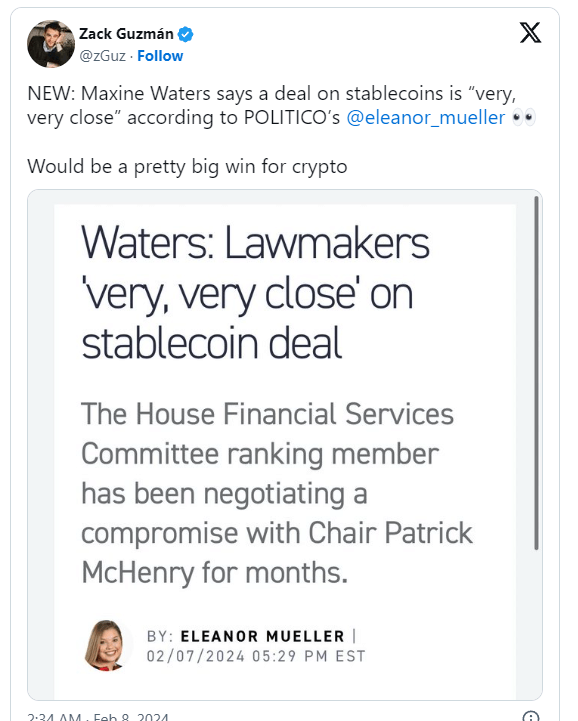

In a recent development that could significantly impact the future landscape of digital currencies, Representative Maxine Waters announced that lawmakers are “very close” to reaching a consensus on a comprehensive stablecoin regulation deal. This statement underscores a pivotal moment for the cryptocurrency industry, as stablecoins have increasingly become a focal point of regulatory discussions due to their growing usage in digital transactions and their potential implications for the traditional financial system. As coinhackz.com delves into the implications of this announcement, we explore what a stablecoin deal could mean for the industry, investors, and the broader economy.

The Significance of Stablecoin Regulation

Stablecoins, digital currencies pegged to a stable asset like the U.S. dollar, have surged in popularity, offering cryptocurrency users a less volatile option for transactions and investments. However, their rapid adoption and integration into the financial ecosystem have raised concerns among regulators about consumer protection, financial stability, and the potential for illicit activities. Lawmakers, led by figures such as Maxine Waters, have been working diligently to craft legislation that addresses these concerns while fostering innovation within the sector.

The Path to a Regulatory Framework

The news of a nearing stablecoin regulation deal indicates significant progress in a dialogue that has often been marked by complexity and contention. Achieving a consensus among lawmakers signifies a collaborative effort to understand the nuances of blockchain technology and its financial products. The proposed regulation is expected to focus on several key areas, including:

- Consumer Protection: Ensuring that stablecoin issuers have the necessary reserves to back their digital currencies, protecting users in the event of market turmoil.

- Financial Oversight: Introducing mechanisms for greater transparency and regulatory oversight to prevent money laundering, fraud, and systemic financial risks.

- Innovation Support: Crafting a regulatory environment that supports technological innovation, allowing the U.S. to remain competitive in the global digital finance arena.

Implications for the Cryptocurrency Industry

A comprehensive stablecoin deal, as hinted by Maxine Waters, could have far-reaching implications for the cryptocurrency industry:

- Market Stability: Clear regulations could enhance the stability and credibility of stablecoins, attracting more institutional and mainstream investors to the cryptocurrency market.

- Innovation and Growth: A balanced regulatory framework could spur innovation, leading to the development of new financial products and services within the blockchain ecosystem.

- Global Leadership: By establishing a clear regulatory stance on stablecoins, the U.S. could set a precedent for other nations, potentially leading to a harmonized global approach to digital currency regulation.

Conclusion

The announcement by Representative Maxine Waters that lawmakers are nearing a deal on stablecoin regulation marks a crucial step toward addressing the challenges and opportunities presented by digital currencies. As the cryptocurrency industry continues to evolve, the establishment of a regulatory framework for stablecoins is essential for ensuring consumer protection, financial stability, and continued innovation. As details of the deal emerge, stakeholders across the financial spectrum will be keenly watching, ready to adapt to the new landscape that this legislation will create. Coinhackz.com remains committed to providing updates and insights into this developing story, recognizing its significance for the future of finance and technology.