In a striking display of market dynamics, the price of Ethereum (ETH) is edging closer to the coveted $4,000 mark, a milestone that has both investors and enthusiasts on the edge of their seats. This surge in Ethereum’s value reflects a broader trend in the cryptocurrency space, where optimism seems to be at an all-time high. However, beneath the surface of this bullish sentiment lies a cautionary tale. As Ethereum’s price trajectory continues its upward climb, the level of optimism among traders could potentially signal a warning. This article explores the implications of Ethereum’s current market position and the caution advised by market analysts.

Ethereum’s Price Surge: A Snapshot

Recent weeks have seen Ethereum make significant gains, with its price trajectory setting it on a path that could soon breach the $4,000 barrier. This rally is part of a larger bullish trend in the crypto market, driven by a combination of factors including increased adoption, favorable regulatory news, and the continuous growth of decentralized finance (DeFi) and non-fungible tokens (NFTs), both of which are predominantly built on the Ethereum blockchain.

The Exuberance Among Traders

The optimism surrounding Ethereum and the broader crypto market is palpable. Social media platforms and crypto forums are abuzz with speculations and projections, many of which point to even higher valuations in the near future. While this enthusiasm is not unfounded, given Ethereum’s pivotal role in the expansion of DeFi and NFTs, it also raises concerns among seasoned analysts about the potential for a market correction.

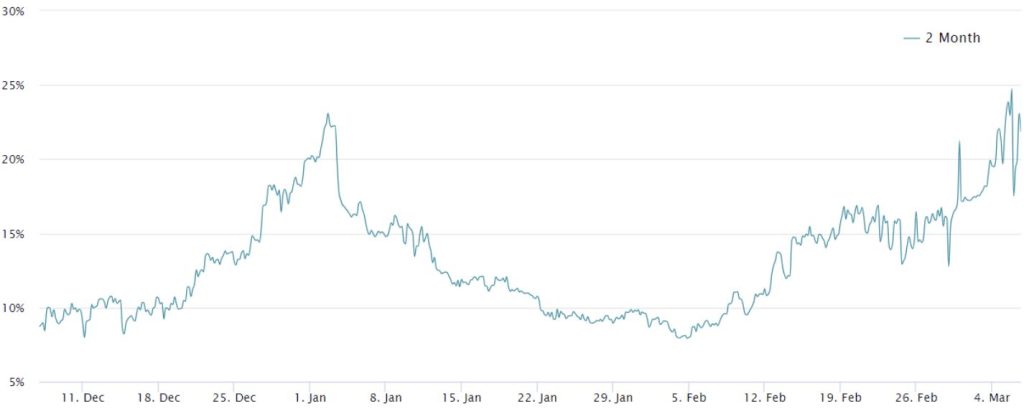

Warning Signs of Over-Optimism

Market sentiment, while a powerful indicator of investor confidence, can also serve as a double-edged sword. Excessive optimism, especially in markets as volatile as cryptocurrency, can lead to speculative bubbles. These bubbles, when they burst, can result in significant losses for investors who enter the market driven by FOMO (Fear Of Missing Out). Historical data from the crypto market has shown time and again that corrections often follow periods of rapid price increases, catching many investors off guard.

The Role of Caution

Experts advise that, amidst the current wave of optimism, traders and investors should exercise caution. Diversification, thorough research, and risk management are crucial strategies in navigating the crypto market’s inherent volatility. It’s also recommended to look beyond short-term price movements and focus on the long-term potential of technologies like Ethereum, which continues to play a foundational role in the blockchain ecosystem.

Conclusion: A Balanced Approach to Ethereum’s Rally

As Ethereum inches closer to the $4,000 mark, the excitement among the crypto community is undeniable. However, this enthusiasm should be tempered with a healthy dose of caution. The market’s current optimism, while reflective of Ethereum’s growing importance, also serves as a reminder of the need for prudent investment practices. By balancing optimism with caution, investors can navigate the complexities of the crypto market, capitalizing on its opportunities while mitigating its risks.