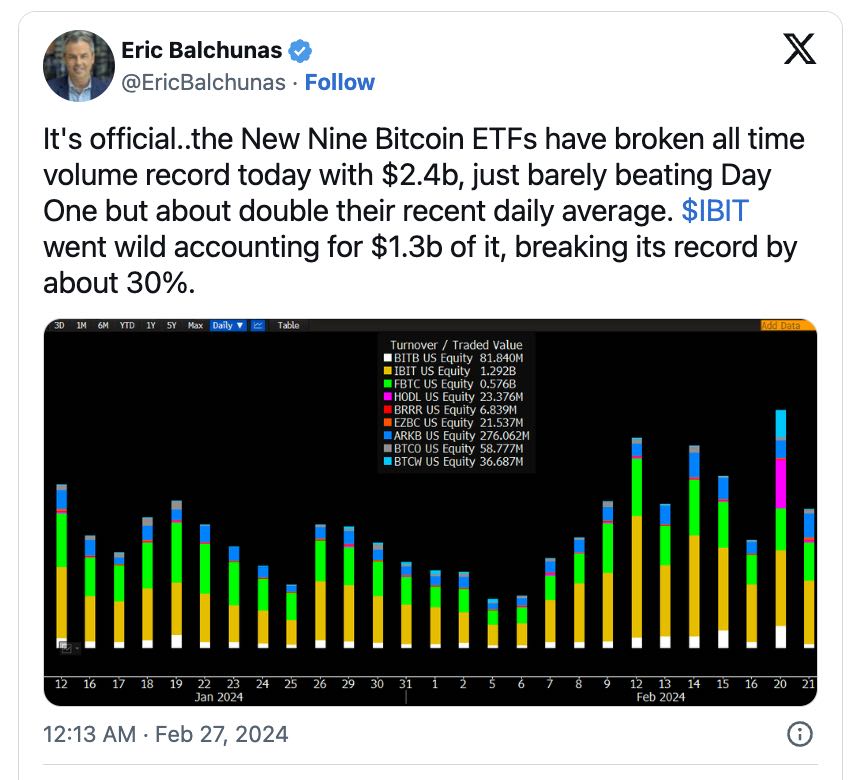

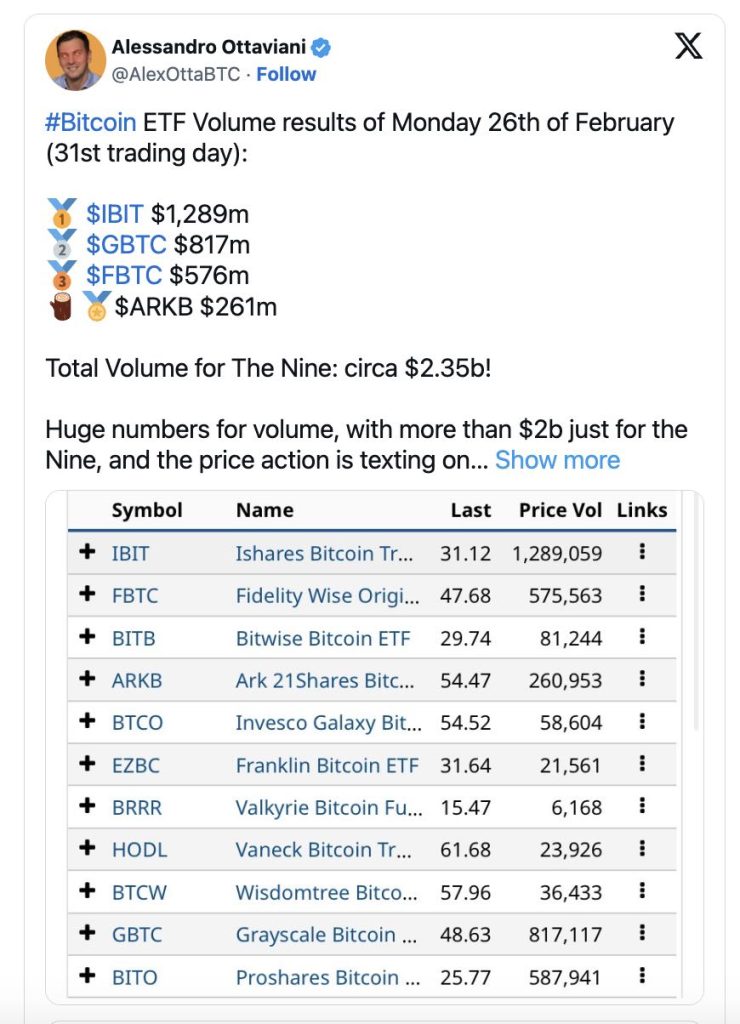

In a significant turn of events for the cryptocurrency market, the ‘New Nine’ spot Bitcoin Exchange-Traded Funds (ETFs) have reached unprecedented daily trading volumes, coinciding with Bitcoin’s price nearing the $55,000 mark. This surge highlights a growing interest and confidence in both Bitcoin as a digital asset and the viability of spot Bitcoin ETFs as an investment vehicle in the traditional financial sector. As enthusiasts and investors alike watch Bitcoin’s ascent, the implications of these developments could signal a new era for cryptocurrency’s integration into mainstream finance.

The Rise of ‘New Nine’ Spot Bitcoin ETFs

The ‘New Nine’ refers to a cohort of recently launched spot Bitcoin ETFs, which have quickly gained traction among investors looking for exposure to Bitcoin without the complexities of direct cryptocurrency ownership. Unlike Bitcoin futures ETFs, which are based on contracts predicting the future price of Bitcoin, spot ETFs are directly backed by the actual digital currency, offering a more straightforward approach to Bitcoin investment.

The increased trading volumes of these ETFs suggest a growing appetite for cryptocurrency investments within traditional financial markets. Investors are increasingly turning to these financial instruments as a way to diversify portfolios and hedge against inflation, driving up demand and, consequently, trading volumes to new highs.

Bitcoin’s Price Momentum

Bitcoin’s price nearing the $55,000 mark is another testament to the cryptocurrency’s resilience and growing acceptance. After experiencing a series of volatile price movements, Bitcoin’s recent rally reflects renewed investor confidence and interest. Several factors, including institutional adoption, increasing recognition of Bitcoin as a ‘digital gold,’ and fears of inflation in traditional currencies, have contributed to Bitcoin’s price momentum.

The synchronization of Bitcoin’s price rally with the surge in spot Bitcoin ETF volumes is not coincidental. It underscores the interconnectedness of the cryptocurrency market with traditional financial systems and how movements in one can significantly impact the other.

Implications for the Cryptocurrency Market

The success of the ‘New Nine’ spot Bitcoin ETFs and Bitcoin’s price rally have several implications for the cryptocurrency market and traditional finance:

- Mainstream Acceptance: The growing interest in spot Bitcoin ETFs indicates a shift towards mainstream acceptance of cryptocurrency as a legitimate asset class within traditional investment portfolios.

- Regulatory Outlook: The popularity and success of these ETFs could lead to a more favorable regulatory outlook for cryptocurrencies, potentially paving the way for more cryptocurrency-based financial products in the future.

- Market Stability: Increased participation in the cryptocurrency market through spot Bitcoin ETFs could introduce more stability to Bitcoin’s price, given the diversified investor base and reduced volatility compared to direct cryptocurrency trading.

- Innovation and Competition: The success of spot Bitcoin ETFs is likely to spur innovation and competition within the financial sector, as more institutions seek to capitalize on the growing demand for cryptocurrency investment options.

Conclusion

The ‘New Nine’ spot Bitcoin ETFs reaching new daily trading highs, alongside Bitcoin’s approach to the $55,000 mark, marks a significant milestone in the cryptocurrency’s journey towards mainstream financial recognition. As the lines between traditional finance and digital currencies continue to blur, the future looks promising for Bitcoin and other cryptocurrencies to become integral components of investment strategies worldwide. For investors and enthusiasts watching these developments, the message is clear: cryptocurrency is not just a speculative asset but a burgeoning pillar of the modern financial landscape.