The cryptocurrency landscape is witnessing a seismic shift as issuers of Spot Bitcoin ETFs engage in a fee war, reshaping the dynamics of these investment vehicles. In a surprising turn, multiple issuers have amended their S-1 filings, revealing strategic reductions in sponsor fees. This classic article for CoinHackz.com dissects the implications of this fee war, explores the motivations behind the amendments, and analyzes the potential impact on investors navigating the ever-evolving world of cryptocurrency.

The Unfolding Fee War

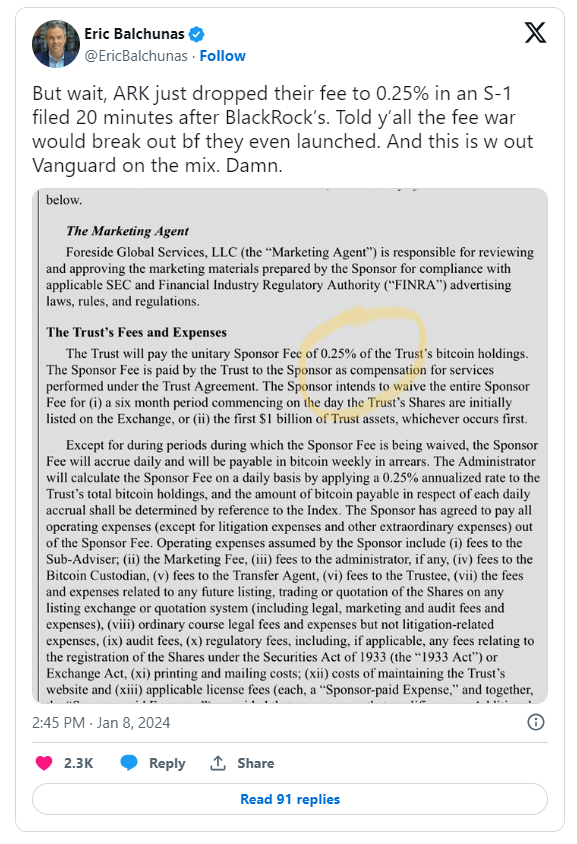

As the crypto community eagerly awaits the approval of Spot Bitcoin ETFs, issuers have entered into a strategic battle over fees. CoinHackz.com unravels the unfolding narrative of this fee war, examining the competitive landscape and the motivations driving issuers to amend their S-1 filings.

Strategic Amendments in S-1 Filings

A closer look at recent S-1 filings reveals a notable trend – issuers are lowering sponsor fees in a bid to attract investors and gain a competitive edge. We delve into the specifics of these amendments, analyzing the strategic considerations behind the decisions to reduce fees.

Implications for Investors

For investors eagerly eyeing Spot Bitcoin ETFs as a potential investment avenue, understanding the fee structures is paramount. CoinHackz.com provides insights into the implications for investors, weighing the pros and cons of reduced sponsor fees and how these changes may impact their investment strategies.

Competitive Dynamics and Market Positioning

The fee adjustments are not merely about cost; they signal a broader play for market dominance. We explore the competitive dynamics at play and how issuers are strategically positioning themselves to capture a larger share of the market once Spot Bitcoin ETFs gain regulatory approval.

Regulatory Landscape and Investor Confidence

In the context of regulatory uncertainties, the article navigates the delicate balance between reducing fees to attract investors and maintaining a level of profitability that ensures the sustainability of the ETF. How these fee adjustments align with the broader regulatory landscape is a critical consideration.

Lessons from Traditional ETF Fee Wars

Drawing parallels with fee wars in traditional finance, CoinHackz.com draws valuable lessons from past experiences. We examine how fee adjustments in the cryptocurrency realm mirror trends in the traditional ETF space and what insights can be gleaned from these historical precedents.

Conclusion

The Spot Bitcoin ETF fee war marks a pivotal moment in the evolution of cryptocurrency investment products. CoinHackz.com remains committed to providing users with timely and insightful updates on this fee war and its broader implications. As the crypto community witnesses these strategic maneuvers, staying informed becomes an indispensable tool for investors navigating the nuances of the ever-changing crypto landscape.