In a remarkable display of market enthusiasm, spot Bitcoin Exchange-Traded Funds (ETFs) have set new trading volume records, coinciding with a period of significant price highs for Bitcoin (BTC). This pivotal moment not only underscores the growing acceptance and institutionalization of cryptocurrency but also signals a potential shift in investor sentiment and strategy regarding digital assets. This article explores the dynamics behind this historic trading activity and its implications for the cryptocurrency landscape.

The Surge in Spot Bitcoin ETFs

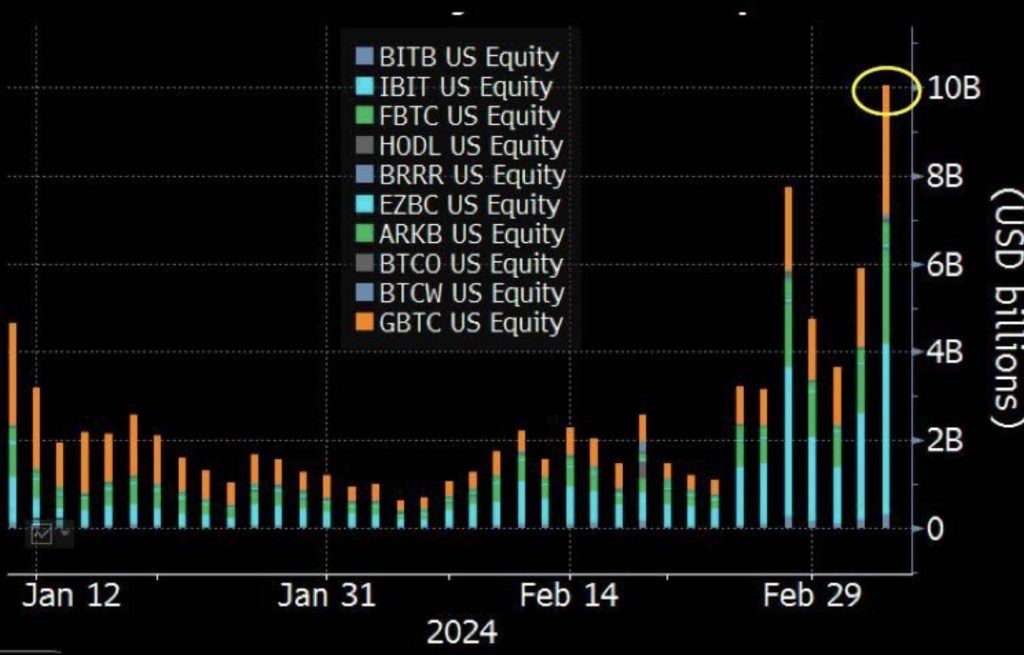

Spot Bitcoin ETFs, which directly hold actual Bitcoin rather than derivatives or futures contracts, have emerged as a critical bridge connecting the traditional investment world with the burgeoning realm of cryptocurrency. The recent spike in trading volumes of these ETFs reflects a heightened interest from both retail and institutional investors, drawn by the allure of Bitcoin’s latest price rally and the convenience and security ETFs offer.

Factors Fueling the Record-Breaking Volumes

Several factors contribute to the surge in spot Bitcoin ETF trading volumes:

- BTC Price Rally: A significant uptick in Bitcoin’s price acts as a magnet, attracting investors aiming to capitalize on the momentum. The correlation between BTC price highs and ETF trading volumes suggests that investors are increasingly turning to ETFs as a preferred method of gaining exposure to Bitcoin’s price movements.

- Mainstream Adoption: The launch of spot Bitcoin ETFs marked a milestone for cryptocurrency acceptance within mainstream finance. As more investors become comfortable with digital assets, ETFs provide a familiar and regulated vehicle for investment, contributing to the volume surge.

- Diversification and Hedging: In times of economic uncertainty and inflation concerns, investors are diversifying their portfolios by adding cryptocurrency assets. Spot Bitcoin ETFs offer a straightforward and regulated avenue for this strategy, appealing to those looking for hedging options against traditional market risks.

Implications for the Cryptocurrency Market

The record-setting trading volumes of spot Bitcoin ETFs carry several implications for the broader cryptocurrency market:

- Increased Legitimacy: High trading volumes in regulated financial instruments like ETFs enhance the legitimacy of Bitcoin and cryptocurrency in the eyes of skeptical investors and regulators, potentially paving the way for further adoption and integration into the financial system.

- Market Volatility: While increased ETF trading volumes can lead to greater liquidity, they may also contribute to market volatility, especially if large volumes of ETF shares are rapidly bought or sold in response to Bitcoin price movements.

- Regulatory Attention: The surge in spot Bitcoin ETF trading volumes is likely to attract regulatory attention, with potential implications for future cryptocurrency regulation and the approval of additional digital asset ETFs.

Conclusion

The record-breaking trading volumes of spot Bitcoin ETFs amid BTC’s price high represent a watershed moment for cryptocurrency’s integration into mainstream finance. As investors flock to these ETFs, driven by Bitcoin’s allure and the advantages of ETFs as investment vehicles, the cryptocurrency market is witnessing a shift towards greater acceptance and institutionalization. However, this trend also brings challenges, including increased market volatility and regulatory scrutiny. As the landscape evolves, the role of spot Bitcoin ETFs will undoubtedly be a critical area to watch, both for investors looking to participate in the crypto economy and for those monitoring the broader impacts on the financial system.