In an era where digital currencies are rapidly reshaping the financial landscape, Fidelity Investments has made a significant stride with its Bitcoin Exchange Traded Fund (ETF). Remarkably, this ETF has reportedly amassed an impressive $208 million, a figure that not only underscores its success but also remarkably offsets the outflows from another industry giant, Grayscale. This development is a pivotal moment in the cryptocurrency world and merits a deeper exploration, especially for enthusiasts and investors frequenting coinhackz.com, a hub for the latest in cryptocurrency news and trends.

The Rise of Fidelity’s Bitcoin ETF

- Market Impact and Investor Confidence: Fidelity’s foray into Bitcoin ETFs has been met with considerable enthusiasm, reflected in the substantial funds it has attracted. This influx of capital into Fidelity’s ETF indicates a growing investor confidence in Bitcoin and cryptocurrency as legitimate and lucrative investment avenues. Furthermore, it highlights the increasing acceptance of digital currencies in mainstream investment portfolios.

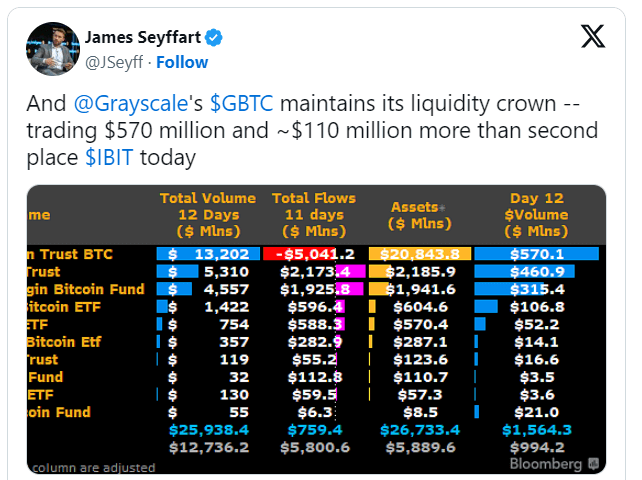

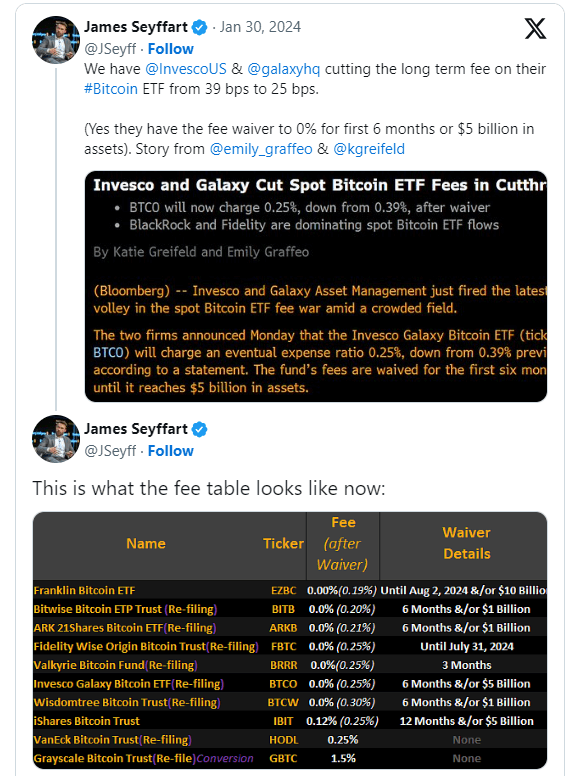

- Comparison with Grayscale’s Performance: Grayscale has long been a dominant player in the cryptocurrency investment space. However, recent times have seen a noticeable outflow of investments from its funds. Fidelity’s ability to not just attract but also offset these outflows is a testament to its growing prominence and the shifting dynamics within the crypto investment landscape.

- Regulatory Environment and Future Prospects: The success of Fidelity’s Bitcoin ETF is also a reflection of the evolving regulatory environment surrounding cryptocurrencies. This environment plays a critical role in shaping investor perception and confidence. As regulations become clearer and more favorable, such financial products are likely to see increased adoption, potentially paving the way for more institutional investments in the crypto space.

The Bigger Picture

However, it’s important to consider this development within the larger context of the volatile cryptocurrency market. While Fidelity’s achievement is noteworthy, the crypto market is known for its rapid fluctuations. Investors should remain aware of the inherent risks associated with cryptocurrency investments, including regulatory changes and market volatility.

Conclusion

Fidelity’s Bitcoin ETF amassing $208 million is more than just a financial milestone; it’s a symbol of the growing maturity and acceptance of cryptocurrencies in the broader financial world. For investors and enthusiasts, this is a moment of optimism, hinting at a future where digital currencies hold a stable and recognized place in investment portfolios. As we continue to witness the ebb and flow of the crypto market, developments like these serve as critical markers of progress and potential. At coinhackz.com, we remain committed to bringing you the latest insights and trends from the dynamic world of cryptocurrency, ensuring you stay informed and ahead in this digital finance revolution.